Diving into the world of data and analytics can be both exhilarating and overwhelming for lenders. A well-structured analytics program can transform raw data into actionable insights, driving strategic decision-making and competitive advantage. However, creating such a program involves several steps and presents numerous challenges. Fortunately, building your first data analytics project plan isn’t as complicated as it may seem. With the right approach and understanding of the data science process, you can effectively navigate the fundamental steps of a data analytics project plan in this exciting age of analytics. Insight Consultants, experts in this field, can guide you in this.

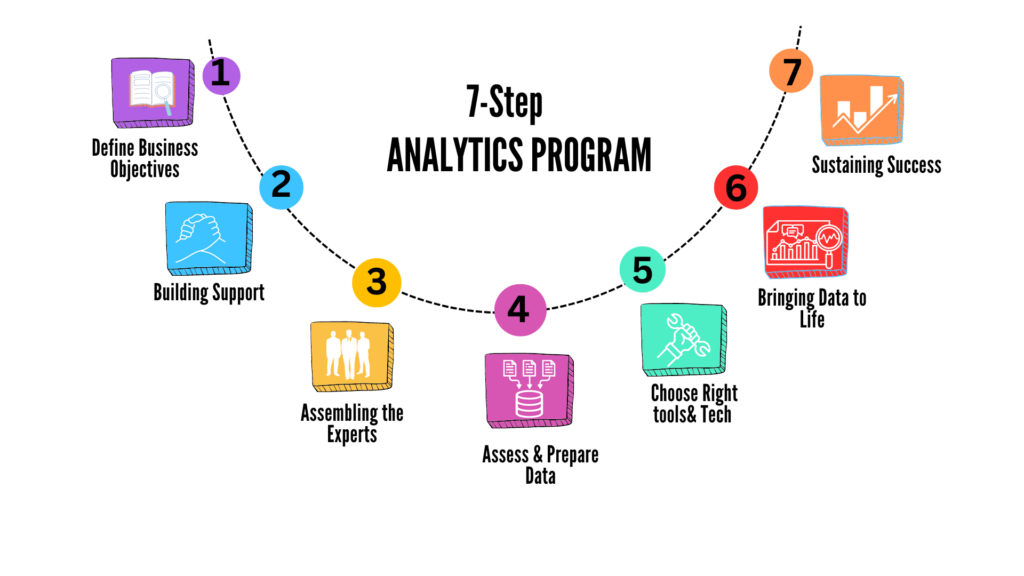

Implementing the Analytics Program in 7 Steps

Diving into analytics for lenders can transform your decision-making process and drive profitability. A structured approach to analytics for lenders helps you leverage data effectively, ensuring your strategies are actionable and impactful.

Key steps:

1. Define Business Objectives

Creating an analytics program requires a structured approach to ensure it aligns with business goals and delivers meaningful insights.

- Identify Key Goals: Determine what the lending business aims to achieve through analytics, such as improving loan approval rates, reducing default rates, or optimizing interest rates. Clear objectives provide direction and focus for the analytics program.

- Set Measurable Objectives: Define specific, measurable objectives that the analytics for lenders will support. For example, aim for a 20% reduction in loan defaults, a 15% growth in loan portfolio, or a 10% increase in customer retention rates.

2 Secure Stakeholder Buy-In

Gaining support from key stakeholders is crucial for the success of the analytics program.

- Engage Leadership: Ensure senior management understands the value of the analytics program and is committed to supporting it. Present the potential benefits and strategic importance to the board of directors and gain their backing.

- Communicate Benefits: Clearly communicate the potential benefits and ROI of the analytics program to all stakeholders. Meet with loan officers and branch managers to explain the benefits and build excitement, ensuring everyone is on board.

3. Establish a Skilled Team

Building an effective analytics program requires assembling a team with the necessary expertise.

- Identify Key Roles: Assemble a team with the necessary skills, including data scientists, credit analysts, IT professionals, and business analysts. Each role is crucial for the success of the analytics program.

- Define Responsibilities: Clearly outline the roles and responsibilities of each team member to ensure accountability. Data scientists build models, analysts interpret data, IT professionals handle infrastructure, and business analysts ensure alignment with lending goals.

4. Assess and Prepare Data

A robust analytics program is built on high-quality, well-organized data.

- Data Inventory: Conduct an inventory of available data sources within the organization, mapping out where loan data, customer information, and transaction records are stored and how they flow through the company.

- Data Quality: Assess the quality of existing data and identify gaps that need to be filled. This step is crucial to ensure the reliability of future insights.

- Data Governance: Establish robust data governance policies to ensure data integrity, security, and compliance with financial regulations. These policies become the backbone of your data operations.

5. Choose the Right Tools and Technologies

Effective analytics requires selecting the appropriate tools and technologies.

- Select Analytics Tools: Based on your objectives and data needs, choose the appropriate analytics tools and platforms. These might include credit scoring models, risk assessment software, and advanced analytics platforms.

- Build a Technology Stack: Develop a technology stack that includes data storage, processing, and analytics capabilities. Ensure it is scalable and future-proof to accommodate growth.

6. Develop and Implement Analytical Models

Transforming data into actionable insights requires developing and implementing analytical models.

- Choose Models: Based on the lending objectives, select the right analytical models. These might include predictive models for credit risk assessment, descriptive models for customer segmentation, and prescriptive models for loan pricing strategies.

- Build and Validate Models: Develop the models using historical loan data and test their accuracy and effectiveness. Validate the models with real-world data to ensure they provide reliable insights.

- Pilot Projects and Scaling: Start with pilot projects to demonstrate the value of the analytics program and refine the approach. Once successful, scale the program across the organization, embedding analytics into daily lending operations.

7. Foster a Data-Driven Culture and Continuous Improvement

Ensuring long-term success requires fostering a data-driven culture and continuous improvement.

- Training and Education: Provide comprehensive training and education to employees to build a data-driven mindset. Promote the use of data and analytics in lending decision-making processes.

- Monitor, Optimize, and Stay Updated: Continuously monitor the performance of the analytics program using key performance indicators (KPIs). Establish a feedback loop to gather insights from users and stakeholders, enabling ongoing refinement and improvement. Keep up with the latest trends and advancements in analytics and data science, ensuring the program remains adequate and relevant.

Overcoming Common Challenges

Creating analytics for lenders is not without its hurdles. Here are some common challenges lenders face and strategies to overcome them:

- Data Quality and Availability: Implement data standardization practices to ensure consistency across sources. Use data integration tools to break down silos and create a unified data repository. Establish a robust data governance framework to maintain data quality and compliance.

- Skill Gaps: Develop strategies to attract, hire, and retain skilled analytics professionals. Offer training programs to upskill existing employees and bridge the skill gap. Partner with external consultants to access specialized skills and knowledge.

- Technological Challenges: Conduct thorough evaluations to select tools and technologies that meet business needs and budgets. Develop detailed integration plans to ensure seamless integration with existing systems. Design the technology stack with scalability in mind to accommodate future growth.

- Data Governance and Privacy: Implement robust data security measures to protect sensitive information. Develop and enforce compliance policies to adhere to data protection regulations. Establish clear data ownership and access rights within the organization.

- Alignment with Business Goals: Engage stakeholders in setting clear and aligned analytics objectives. Develop methods to measure and demonstrate the ROI of analytics initiatives. Conduct regular reviews to ensure alignment with business goals and adjust as needed.

How Insight Consultants Drive Your Success

Our expertise and customized approach will guide you every step of the way, ensuring your analytics program drives impactful results. Here’s how we make a difference:

| Services Provided | Support & Optimization |

| Expert Guidance | Insight Consultants bring deep expertise and best practices to guide the development and implementation of your analytics program. Strategic Planning: Ensuring alignment with business goals, maximizing RO I, and crafting a roadmap for success. Regulatory Compliance: Navigate the complex landscape of financial regulations to ensure your analytics initiatives meet all necessary legal requirements. |

| Customized Solutions | Offer tailored solutions designed to meet your specific business needs and objectives, including: Tool and Technology Selection: Assisting you in selecting the most appropriate analytics tools, such as advanced credit risk assessment software, loan origination systems, and customer segmentation platforms. Data Integration: Designing and implementing data integration solutions to unify disparate data sources, ensuring comprehensive and accurate data analysis |

| Training and Support | Provide robust training programs and ongoing support to ensure the smooth functioning of your analytics program Employee Training: Offering workshops and courses to upskill your workforce, focusing on data literacy, analytics tools, and interpreting data insights. Change Management: Developing strategies to foster a data-driven culture, including managing resistance to change and promoting the benefits of data-driven decision-making. |

| Continuous Optimization | Monitor the performance of your analytics program and provide actionable insights. Performance Monitoring: Utilizing key performance indicators (KPIs) to track the success of your analytics initiatives and identify areas for improvement. Feedback Loops: Establish regular feedback sessions with stakeholders to gather insights and refine analytical models and processes. Technological Advancements: Keeping you updated with the latest trends and advancements in analytics and data science, ensuring your program remains cutting-edge and effective. Scalability: Advising on the scalability of your analytics infrastructure to accommodate future growth and evolving business needs. |

Conclusion

The transformative potential of analytics in the lending industry cannot be overstated. By harnessing the power of data-driven insights, lenders can make informed decisions, enhance customer experiences, and gain a competitive edge in an evolving marketplace. Lending firms can maximize the benefits of predictive analytics by aligning business goals with analytical outcomes, selecting the right analytical partners and tools, and leveraging data visualization capabilities.

With several years of experience in the lending domain, Insight Consultants offers a robust, user-friendly solution that enables informed decision-making through accurate predictions and easy-to-build decision models.

Contact us if you are looking for ways to harness the power of data analytics.