The Vital Role of Financial Inclusion

Financial inclusion is the key to building a strong and growing economy. Ensuring everyone has access to financial services and products, no matter who they are or where they come from is crucial for building a strong and thriving economy. There are a ton of people out there who do not have access to essential financial services like bank accounts.

About 22% of adults in the US, or 63 million people, do not have access to bank accounts or struggle to get access to financial services. The lack of access to traditional banking services among certain groups can create challenges for lending businesses. These individuals and families may struggle to save, build credit, and access other financial products. However, lending companies can help bridge this gap and reach underserved markets by leveraging data sources and innovative technologies.

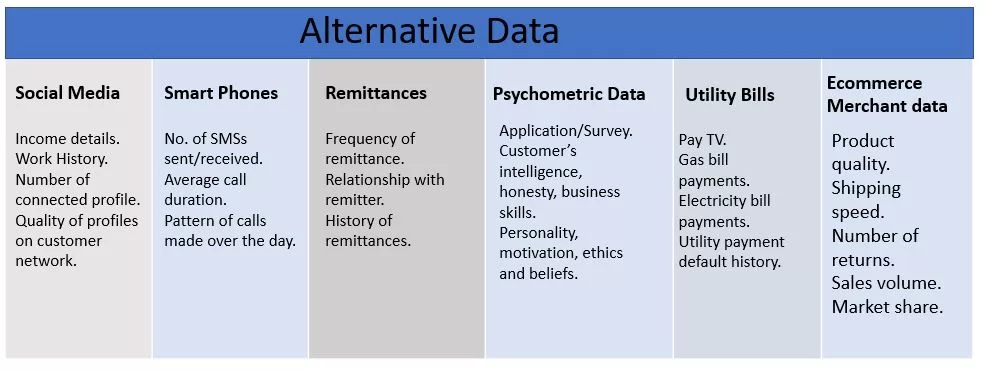

The use of data and digital technologies can help expand access to financial services by making it easier and more cost-effective to provide new financial products and services to underserved populations. Additionally, alternative credit scoring models that leverage non-traditional data sources, such as social media activity or utility bill payment history, can help expand credit access for individuals lacking a traditional credit history.

Unlocking Financial Inclusion Through Alternative Data

Emerging market populations that lack access to traditional banking services face exclusion from mainstream financial systems due to their limited or non-existent credit histories. However, using individual data assets such as smartphone usage and utility payment history can be a meaningful change in promoting financial inclusion for these individuals. This data can enable alternative credit scoring methods, alternative acceptance criteria for financial services, non-traditional account setup options, and streamlined identity and know-your-customer (KYC) verification processes. Leveraging this data enables organizations to adequately reflect the unique circumstances of a specific unbanked community, promoting greater financial inclusion. Overall, the data revolution can transform the economic landscape by enabling greater financial inclusion and improving the financial health of individuals and communities worldwide.

Bottlenecks in Traditional Credit Assessment

With more people getting online and doing stuff digitally, the world of finance is revolutionizing. The emergence of new-age financial services such as digital lending, e-Wallets, physical banking, Buy Now Pay Later (BNPL), and other fintech innovations significantly promote financial inclusion. But, even with all these new options available, access to credit is still shadowed by archaic underwriting systems. The limited accessibility to credit poses a significant threat to the equitable distribution of income and wealth, thereby impacting macroeconomic stability.

Top hurdles traditional credit assessment faces today:

- Limited Data Availability: Traditional lenders rely heavily on credit scores and credit reports to make lending decisions. The limited data availability can make it challenging for lenders to assess risk accurately.

- Slow Decision Process: Traditional lenders typically have a lengthy application and underwriting process, which can take several days or weeks to complete. It can be frustrating for borrowers who need access to funds quickly.

- Lack of Personalization: Traditional lenders often use a one-size-fits-all approach to credit decisions, which may not consider individual circumstances or unique financial situations.

- High Costs: The cost of underwriting and servicing small loans can be prohibitively high for traditional lenders, making it challenging to serve low-income and underserved communities profitably.

Think you need a traditional credit score to get a loan? Think again– using innovative technologies and alternative data such as bank transaction history, rent payments, and utility bills, lenders can make more accurate credit decisions and reach underserved markets with limited access to traditional banking services.

Alternative Data to the Rescue

Banks, Lenders, and other financial institutions must undergo a fundamental shift in assessing creditworthiness to enable the inclusion of “credit invisible” customers and facilitate their integration into the formal financial system. It is where alternative data can unlock terabytes of economic opportunity. Lenders can better understand potential borrowers’ risk profiles using alternative data and help bring more people into the financial fold.

Gone are the days of solely relying on traditional credit scores to determine creditworthiness. Lenders can evaluate borrowers based on their job stability, income, and spending habits with alternative data. In the past, lenders may have overlooked people due to their lack of credit history. However, with advanced data analytics tools and alternative data sources like social media and payment histories, it is now possible to consider these individuals for loans. By leveraging this new source of information, lenders can make more informed decisions, leading to increased access to credit for those who need it the most. Not only does this help to promote financial inclusion, but it can also reduce the risk for lenders. So, it is a win-win situation for everyone involved!

Recent developments around AI-powered analytics and alternative data have created a way for credit-invisible to apply for credit now. AI technologies and machine learning solutions provide instant insights from various datasets. An AI model can rapidly evaluate copious quantities of alternative credit data, reducing the processing time significantly. More notably, machine learning algorithms can recognize trends in unstructured data that help determine the customer behavior of a loan borrower and predict the ability to repay the loan.

Alternative Data and its Growing Popularity

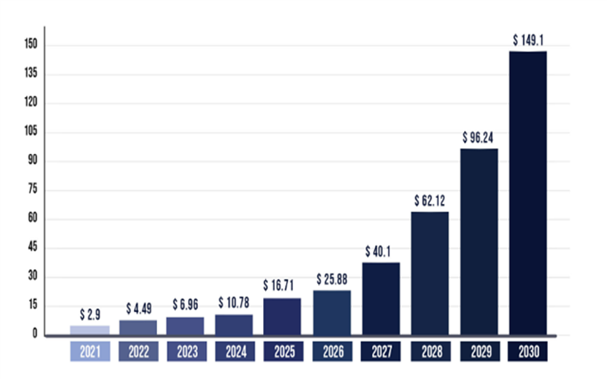

According to research analysis conducted by Precedence Research, the global market for alternative data has seen an exponential rise in providers in recent years, with many financiers and investment managers increasingly investing in this field. The alternative data market was estimated to be USD 4.49 billion in 2022 and projected to be approximately USD 149.1 billion by 2030, reflecting a compound annual growth rate (CAGR) of 54.92% between 2022 and 2030.

Alternative data market size 2021-2030 (USD Billion)

FIs (financial institutions) worldwide are increasingly tapping into alternative data sources to expand their customer base and gain a better view of their customers who may have inadequate or no financial history. By incorporating alternative data sources in credit assessment and banking processes, lenders can make more informed decisions about their unbanked customers and offer them appropriate financial products and services. It benefits the unbanked customers and helps the banks tap into a previously underserved market and expand their business.

Key market trends

- Launch of next-generation platforms: The alternative data industry is experiencing notable advancement by introducing next-generation platforms like AI & ML, cloud-based, and Natural language processing platforms. Key players in the sector are directing their effort toward releasing these platforms, which aim to offer up-to-date and relevant insights.

- The rise in players: Many firms provide systems that can mine data from satellite images, social media sentiment, and IoT device data.

Benefits of Using Alternative Data in Credit Decisioning

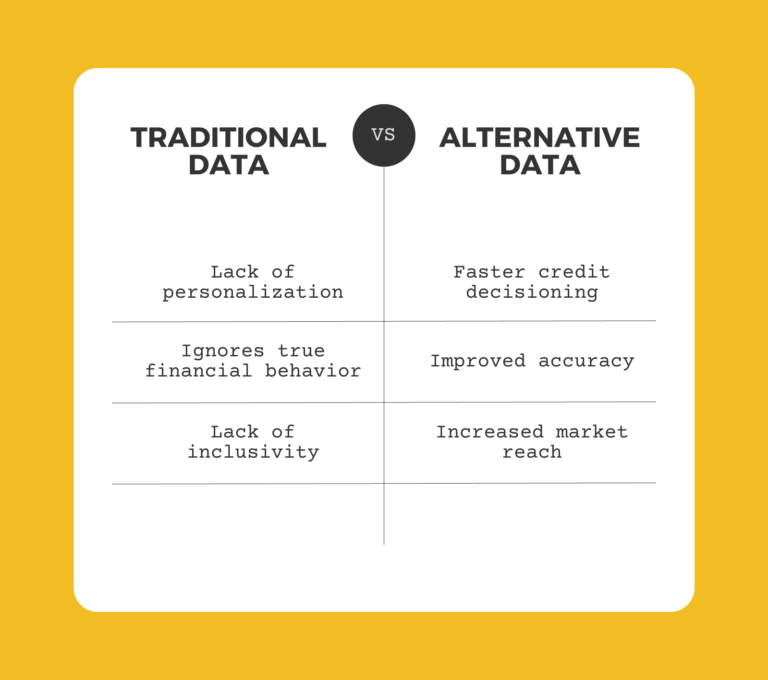

Alternative credit scoring boosts acceptance rates and lower credit losses. Incorporating non-traditional sources of information in credit scoring can offer several advantages, including:

- Improved accuracy: Non-traditional data provides a more comprehensive view of an individual’s creditworthiness, allowing lenders to make more informed decisions.

- Faster credit decisions: Real-time data can be collected and analyzed quickly, allowing lenders to make faster credit decisions. According to a study by Experian, lenders who use alternative data to make credit decisions can reduce their time to make decisions by up to 30%.

- Lower risk: Incorporating non-traditional data in credit scoring enables lenders to assess better the risk associated with lending to specific individuals, resulting in more accurate credit decisions and potentially lower default rates.

- Cost Effective: Lenders can decrease loan origination expenses by utilizing alternative data in credit scoring, potentially allowing them to pass on savings to borrowers through reduced interest rates.

- Increased market reach: Students and young professionals often struggle to obtain loans due to gaps or issues in their credit scores. However, alternative data credit scoring can strengthen their loan applications by considering their timely payments of bills, charges, and other household expenditures. Even those with low or non-existent credit scores can have a high chance of securing loans if they have a positive track record of bill payments and financial responsibility.

Implications for Lenders and Borrowers

Alternative data has significant implications for both lenders and consumers. By leveraging non-traditional data sources, lenders can expand their customer base and tap into the unbanked and underbanked population previously considered ineligible for loans due to the lack of traditional credit history. It creates a tremendous growth opportunity for lenders and facilitates more inclusive financial services for consumers.

For borrowers, alternative data can lead to a more accurate assessment of their creditworthiness and better access to financial services that were previously out of reach. It can result in improved financial stability, more favorable loan terms, and greater access to credit to achieve their financial goals.

However, it is essential to consider the potential risks of using alternative data, such as introducing new biases or inaccuracies, compromising consumer privacy, and creating new forms of financial exclusion. Therefore, the industry must approach alternative data with transparency, caution, and ethical considerations. Regulators must establish guidelines to ensure that the use of alternative data is fair and transparent for all consumers.

Overall, the greater adoption and responsible use of alternative data in finance can provide significant benefits, including improving financial inclusion and leading to more efficient and effective investment decisions.

Innovate Now

While technology has made it easier to adopt efficient approaches to credit assessment, many lending firms face inertia that prevents them from moving forward. However, by partnering with Insight Consultants, your firm can extract the right alternative data and achieve realistic credit assessment by leveraging Insight Consultants’ AI scoring models and data analytics expertise.

We are just a call away. Click here to contact us.