Using effective credit scoring model in decision making

“Buy now, pay later” is a tempting offer made by many firms to their customers to increase their customer base. However, both parties need to be aware of the risks when making such credit decisions. Inconsistent or unreliable approaches to credit analysis expose firms to unnecessary risks. Lenders must be able to assess the risk […]

Making Debt Collection a Win-Win Deal

Newsletter | January 2020 | Issue 101 Focus On Making debt collection a win-win deal Loan approval has become much easier in the recent past. But debt collection is still a daunting task which affects the productivity of lenders and slow down their operations. With increasing consumer debt, the traditional debt collection methods […]

How Automation can help lenders achieve faster loan processing time?

Loan processing is often a complicated and time-consuming process. It works with multiple partners and business providers. Before its completion, on an average, it will take 20-30 days to close a loan. But today’s customer expects fast, seamless and hassle-free access to loan services at a time, place and channel of their choice. They seek […]

Top 7 Fintech predictions for 2020 and beyond

Fintech is evolving so fast and the Global investments in FinTech more than tripled in 2014, reaching more than $12 billion. It is a revolution which is changing consumer behaviour. Fintech industry is experiencing digital transformation, and we’ll soon see it different from what we have now. Let’s check out the top 7 fintech predictions […]

Robotic Process Automation: Automate manual task to create efficiency

Banks / Lending firms / credit bureaus have spent many years looking for ways to reduce the cost of operation, increase efficiency and to enhance their customer experience. But inefficiencies remain from decades of ‘throwing bodies’ at operational gaps. Now, thanks to technologies like robotic process automation (RPA), is rapidly expanding to more mundane parts […]

Digitized credit risk management: Approach and benefits to lenders

When you lend money and provide credit, you put yourself in a vulnerable position. Smart lenders minimize their credit risk by knowing exactly what they are getting into, and how predictable they can forecast activity on the loans. To boost the quality of the overall loan portfolio, lending firms need to reset their value focus […]

Chatbots – Your AI-based virtual assistant

Chatbots are changing the way brands interact with their customers, and when the chatbot is of high quality, those changes are usually positive. Businesses can reduce customer service costs by up to 30% by implementing conversational solutions like chatbots. over 80% of service queries are repetitive, and a virtual assistant that can cut down wait […]

The Cloud – A game-changer for your business

Cloud computing is just another revolution in how computing power is delivered to a business. It allows businesses to store all data on remote servers, making it easier and cost-effective for both internal users and customers to access it from any place, any time. Small business owners who want to reduce costs without sacrificing their […]

Rise of the Machines: Automation is reshaping business operations

In this ever-changing world, businesses need to pursue strategies which reduce cost, save time and increase efficiency. Businesses need to evolve quickly, make sure you keep abreast of the latest automation possibilities within your business sector. Any business that wants to stand out should consider automation, which can simplify change company’s operations, not to mention […]

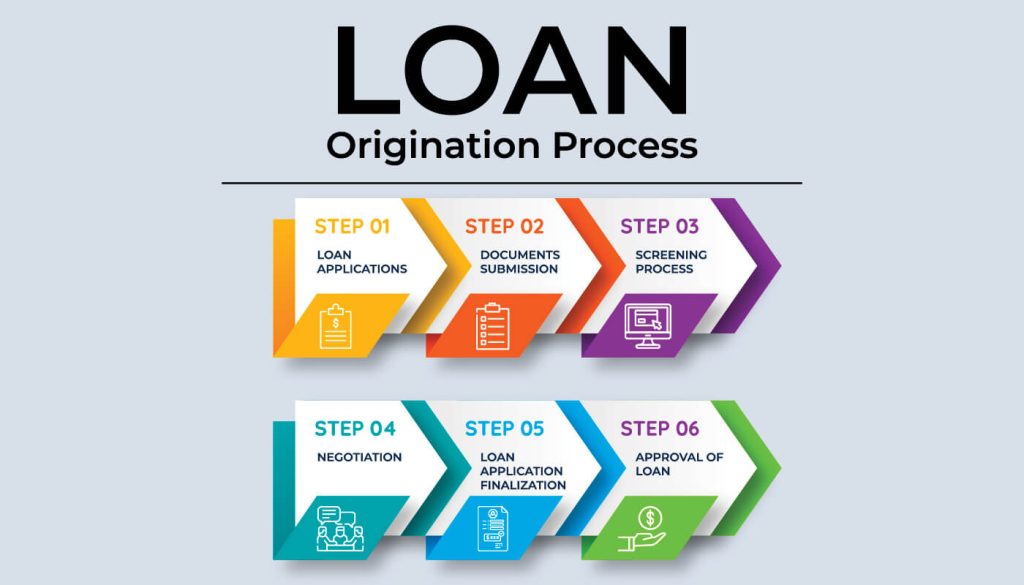

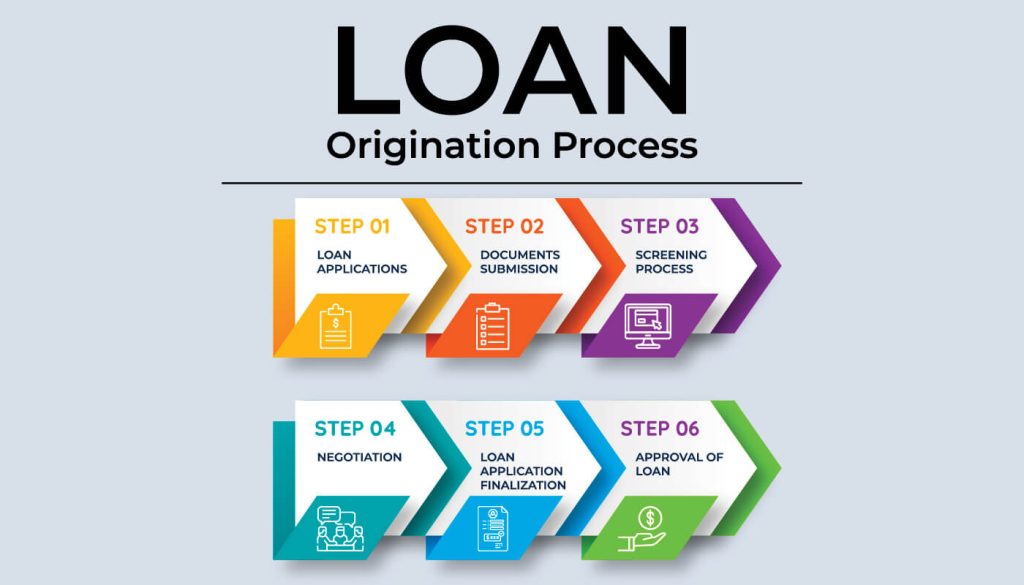

How software addresses the challenges in loan origination

In the dynamic landscape of lending, staying competitive necessitates a tailored loan processing solution that seamlessly evolves with your business. However, both lenders and borrowers encounter various challenges throughout the loan closing journey. Let’s explore major origination challenges and how software solutions can effectively tackle them: Do you have the effective technology to streamline your […]