Loan Origination Software: Continuous Integration Shift

Insight Consultants have been involved in the design, development

Credit management to enhance business performance-How to improve?

Risks are an inevitable part of financial operations, but that does not mean they cannot be mitigated. Commercial banks and private lenders are constantly taking efforts to reduce the risk of fraud and to protect the financial information of their clients. But taking right steps to deal with credit risk is an essential step. You […]

How AI & Alternate data help Lenders in Credit decisioning

The fact is, as many of 30% of adults in today’s credit market are virtually invisible to traditional screening methods. The growing population of digital natives, students, and recent immigrants do not fit neatly into the spending and borrowing habits of previous generations. Most lending tools do not recognize this massive opportunity. It is not […]

How AI & Alternative Data can help Lenders in Credit Decisioning

Monthly Newsletter | May 2021 | Issue 112 Featuring Focus On How AI & Alternative Data can help Lenders in Credit Decisioning A new generation of consumers are changing the lending landscape. Without credit, it is nearly impossible to buy a home or start a business. People face barriers to accessing credit or pay […]

Managing member experience during the Covid 19-Tips to Credit Unions!

Like any other industry, COVID-19 has created new, immediate needs for credit unions: Rapidly transitioning to remote work, serving members with reduced branch availability, reallocating branch staff to address increased call center traffic and supporting members in financial distress through deferments, emergency lending and more creative, tailored arrangements. Now it is the time for Credit […]

Technology and Accounting – The Mutual Partners

Introduction As everyone has their own mother tongue, it is said that accounting is the core language of business. This language is playing a crucial role ever since ages. At the initial stage, accounting was a tough process to think and to do. But now, all the technological changes played a part in making the […]

How to increase sales revenue through AI-driven Lead Scoring?

Converting a potential lead to a paying customer is a tough task. The Sales team must sort through a long list of potential customers every time to figure out how to spend their time. Sales teams have a larger amount of data at their disposal. Even though data and intuition show that some leads are […]

6 Tips For Effective Task Management

Ticking off tasks is one of the most critical components of any organizations success. It starts off when top level management puts down a strategy for a certain duration to achieve a business goal. Then that strategy gets broken up into team level goals that each of us have to work on. Then these goals […]

Transform Credit Union functioning with Cloud Migration

Member service is the pillar of Credit Union Industry. Credit Unions strive to make their services more efficient to their customers. At the same time, it is true that credit unions have tough job on their hands to make themselves more attractive to the millennial generation. When it comes to facing competition from retail banks […]

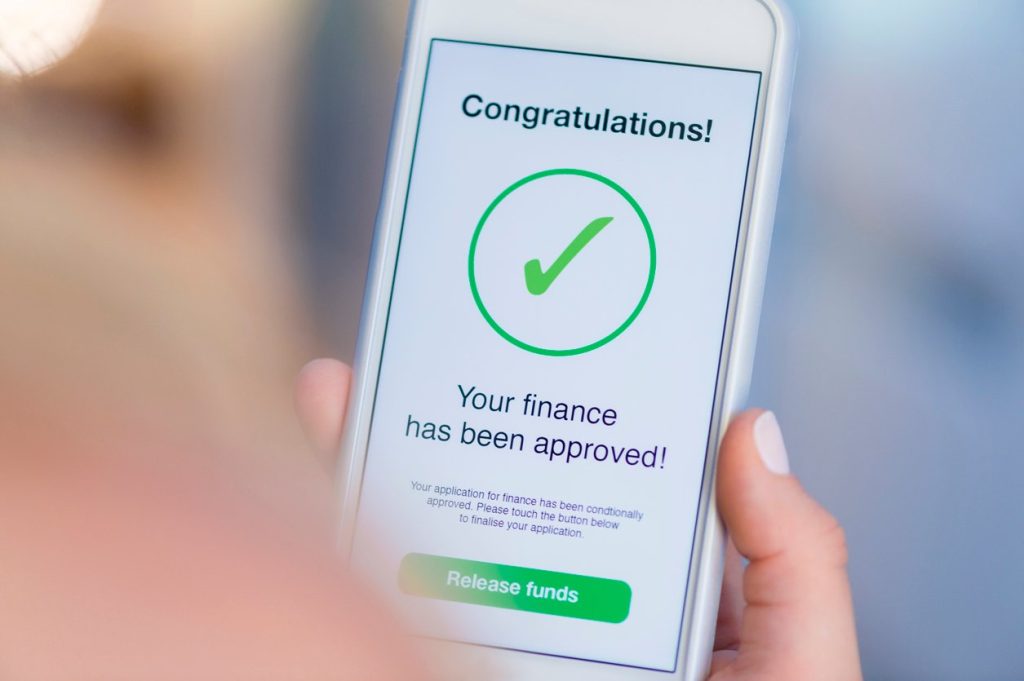

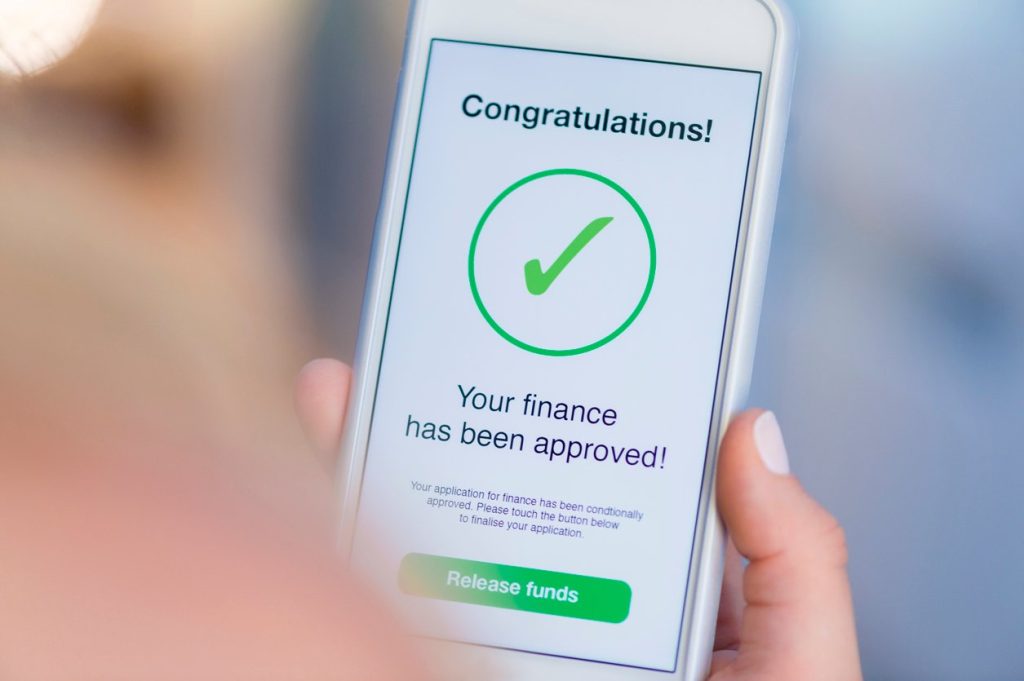

Open Banking in Simplifying Payments-how it helps?

As financial institutions shift toward a digital end-to-end lending process, they are setting the groundwork for a new era in banking founded on Fintech partnerships and an open ecosystem. Rise of open banking Open Banking—driven by regulatory, technology and competitive dynamics—calls for banks to use APIs to make certain customer data available to non-bank third […]