Reconciliation is a critical component of financial services. Data Reconciliation describes the method of verifying and validating data collected from multiple systems, and is required to ensure that data is properly consumed by transactional systems while preventing any potential loss of information.

But, reconciliation at many firms remains a laborious, time-consuming and risk-laden process, where employees are forced to hunt through piles of spreadsheets and tick off every transaction manually. This approach is inefficient and unsustainable, severely limiting firms’ ability to compete.

Lending firms are going through a tough phase in reconciliation due to challenges posed by business and regulatory requirements. Many firms still follow traditional solutions, that are driven by hard-coded rules. As a result, companies have limited real-time data, and little time (if any) is left for analytics that can help identify errors or required adjustments.

Major reconciliation challenges include:

1.Reconciling of ever-increasing volumes of trade transactions

2. Manual reconciliation errors that leads to potential operational risks

3. Complexity of new instruments coupled with regulatory compliance and audit demands

4. Inability to apply complex, multi-step matching rules

5. Challenges in identifying, handling and/or managing exceptions

6. Siloed operations`

Apart from these, traditional methods create more widespread challenges, including system performance issues, and ultimately delays in the close process.

Isn’t it time for a change?

This is when Automation can help! Why waste your time manually reconciling data when it can be automated!

Using automation to improve efficiency and reduce data reconciliation cost

The emergence of Artificial Intelligence – specifically Machine Learning – an advanced analytical tool can dramatically improve efficiency in the reconciliation process and save your team’s hundreds of hours of manual processing time.

AI and Machine Learning technologies can analyze and evaluate a high volume of data. They can perform repeatable tasks with zero room for error – quickly, accurately and effectively.

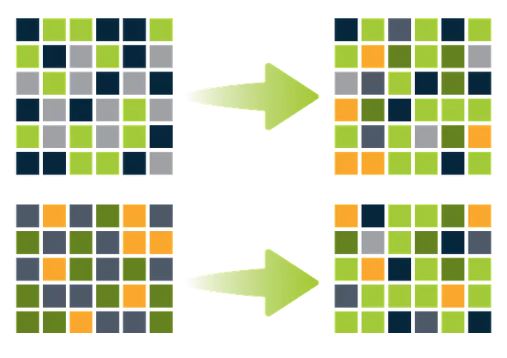

Essentially, ML works by extracting the relevant documents and data. It, then, performs a quick check to spot any discrepancies. Data is matched at the transaction level, and mismatches and discrepancies are identified. Next, investigates the reconciling items, fixes errors, and get approvals. Once approved, the entries are finalized, and updates are closed.

What you gain?

1.Reduce the time and labor hours it takes to reconcile transactions by up to 90%

2.Eliminate costly errors due to human input of manual and rules-based matching

3.Reduce the time to close each month

4.Removal of skilled employees from repetitive tasks

5.Improved and consistent dispatch performance regardless of business volume

Insight Consultants has solutions for reconciliation compliance requirements in the most seamless, cost effective method.

Our solution can:

1.Ingest any data type and process any reconciliations

2.Go far beyond simple matching to include data disaggregation, workflow and exception management.

3. Reduce the risk of errors and speed up the process

4.Offer full traceability and compliance

5. Complete reconciliations sooner

6.Provide easy-to-read reports and tables

7. Correct discrepancies quickly

The persistent need to continuously improve operational efficiency and contain costs makes improving the reconciliation process more important than ever. More automated reconciliation processes are a key tool for organizations that are seeking to improve precision and speed and reduce costs.

Do you have a burning question about improving your reconciliation processes?