Monthly Newsletter | May 2021 | Issue 112

Featuring

- How AI & Alternative Data can help Lenders in Credit Decisioning

- Solve your Credit Decision challenges with the power of Analytics

- Tech Bites

- In the News

- Major Events

- Key Stats

Focus On

How AI & Alternative Data can help Lenders in Credit Decisioning

A new generation of consumers are changing the lending landscape. Without credit, it is nearly impossible to buy a home or start a business. People face barriers to accessing credit or pay more for credit for several reasons. Some have negative items on their credit report, such as a record of late payments. Some have trouble documenting their income. The fact is, as many of 30% of adults in today’s credit market are virtually invisible to traditional screening methods. The growing population of digital natives, students, and recent immigrants do not fit neatly into the spending and borrowing habits of previous generations. Most lending tools do not recognize this massive opportunity. It is not fair for either borrower or lender. And that’s where AI & Alternative Data comes in.

So, let us see how AI & Alternative Data Help Lenders Grow in Today’s Changing Market’.

Here are different ways AI & Alternative data positively influence the changing credit market.

Improved assessment of creditworthiness using alternative data: Effective credit risk management begins with finding the right data for today’s growing market segments. The Consumer Financial Protection Bureau (CFPB) estimates that 26 million Americans are credit invisible or “no file”—they have no credit history with a nationwide consumer reporting agency. Traditional account screening services deliver little or no predictive insights to several consumers. By combining uncorrelated alternative data with traditional credit scores, lenders can maximize the data coverage for their markets—an absolute requirement for optimizing revenue growth.

Predictive Analytics to make profitable decisions: When it comes to AI-powered analytics, one size does not fit all. Lenders have various business goals and tolerance for risks. Markets vary by industry and patterns of risk. The most effective use of AI tailors AI-powered analysis for specific lenders, and then refines that analytical model over time, giving lenders an increasingly predictive and accurate score for credit risk assessments.

By customizing analytics and refining those analytics over time, lenders can optimize their loan-decision processes for growth. By applying customized AI-powered analytics to alternative data, lenders can discover predictive signals that other screening services miss, leading to 20-30% more profitable accounts.

Using AI to bring transparency to compliance: By using sophisticated AI techniques to analyze disparate types of traditional and non-traditional data, it is possible to separate the signal from the noise and deliver insights that are both predictive and interpretable. Explainable AI enables lenders to apply AI techniques at the top of a data waterfall, accepting more profitable accounts before additional data costs are incurred.

When lenders use Explainable AI to gain predictive insights, they can grow profits while helping ensure compliance.

Optimize Waterfall: The ability to bring custom analytics to your data waterfall offers a powerful advantage for lenders looking to add customers and reduce risk. Lenders should look for credit risk scores with easily integrated APIs and insights that can be applied to any point in data waterfalls, giving lenders the freedom and flexibility to tune loan decisions for the best possible results.

AI & Alternative data, the game changers

AI-powered analytics and alternative data provide the predictive analytics lenders need in a world of tightening credit, digital innovation, and increased competition. These new tools help lenders see more, accept more, and grow more. Using AI and unique, uncorrelated, alternative data, lenders can identify the millions of creditworthy customers that traditional screening miss, even from thin- file and no-file households. A generation of digital natives qualifies for the credit they deserve, while lenders gain fast, fair, and frictionless access to the consumers they need to grow business, reduce risk, and maximize profits.

Insight Consultants can help you in

a) Reaching potentially profitable accounts that traditional screening misses

b) Fine-tuning data waterfalls to deliver more predictive insights at any stage.

c) Re-evaluating rejected applicants with more accurate assessments.

d) Establishing the most effective metrics for making lending decisions

Reach Out to us to grow your profitable accounts while reducing risk, First Payment Default (FPD), fraud, and charge-offs.

Keep Reading

Predictive Analytics in solving your credit decision challenges

“Buy now, pay later” is a tempting offer made by many firms to their customers to increase their customer base. However, both parties need to be aware of the risks when making such credit decisions.

The consumer lending business is centered on the notion of managing the risk of borrower default. Inconsistent or unreliable approaches to credit analysis expose firms to unnecessary risks. Lenders must be able to assess the risk of default for each customer so that they can decide to whom the offer should be granted, or actions should be taken.

Unfortunately, accurately estimating the credit risk of a borrower is the most challenging task many lenders face. Data and analytics can play a huge role in reducing inefficiency and streamlining business operations.

Here, Predictive analytics helps lenders to identify the chances of uncertainty and provide guidance for the identification, measurement, and monitoring risk

Predictive analytics (Predictive modelling) is a subset of business intelligence that analyzes past behaviors to predict the future. It is the method of analyzing and modelling data to gather insights that can be used to make meaningful decisions. It includes mathematical techniques, machine learning techniques, and processes that are applied to historical data, identifies trends, and make the best valuation of what will happen in the future.

Predictive Analytics provide Data Insight

Many a time, borrowers who might seem to make for perfect candidates for loan origination might show erratic payment and financial behavior, once their loan is approved. This is something that the underwriters might not be able to predict at the time of loan origination. Delinquency prediction helps the lenders see the risk by observing and studying a large set of consumers and their financial behaviors using statistical models that help in removing biases and errors to give you a score, close to perfection.

The power of big data technologies and analytics allows firms to constantly evaluate their customers’ performance and enables them to reduce exposure to risk and creates cross-sell/upsell opportunities to stay ahead of the competition. The level of default/delinquency risk can be best predicted with predictive modeling using machine learning tools. Predictive models combine vast amounts of data and sophisticated analytic techniques to make predictions about the future. They help us reduce uncertainty and make better decisions.

Typically, the workflow of a predictive analytics application follows these basic steps:

1.Import data from varied sources, such as web archives, databases, and spreadsheets.

2.Clean the data by removing outliers and combining data sources.

3.Develop an accurate predictive model based on the aggregated data using statistics, curve fitting tools, or machine learning.

4.Integrate the model into a load forecasting system in a production environment.

To get maximum benefits from Predictive Analytics solution, businesses need to follow a few steps, which include:

1.Ensure that company-wide data policies are aligned towards making the data easily accessible, as well as establishing a pipeline to continue a streamlined data collection process.

2.The integration of predictive analytics platforms would also require financial domain experts to work in collaboration with data scientists to arrive at more accurate models

Without a shadow of doubt, predictive analytics can take things a level ahead by providing valuable insights to decision-makers for designing the next action.

Insight Consultants Offer

Insight Consultants provide comprehensive business insight into credit risk-management of lenders. The solution uses sophisticated credit scoring models to allow credit risk managers and credit analysts to create predictive scorecards. It also incorporates defined metrics that provide a unified view of customers across lines of businesses and channels. The solution focuses on the three key tenets of efficient risk management in lending: Informed Decisioning, Enhanced Portfolio Management, and Fraud Prevention.

If you’re ready to take the next step Contact Us and find out more about how Predictive Analytics can transform your credit decisioning!

Tech Bites

4 rarely used JavaScript Operators

Even though we have worked with JS, there are certain powerful operators that are unknown or not used. Lets have a look at these 4 JavaScript operators that you might not have or never heard of.

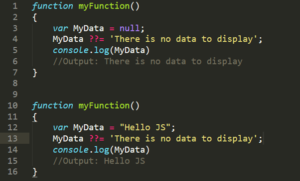

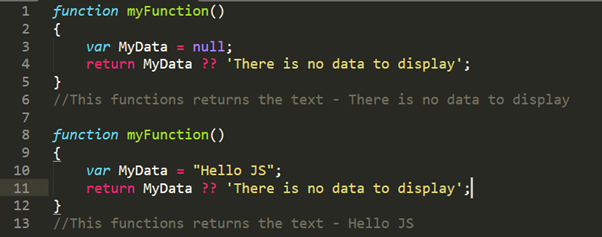

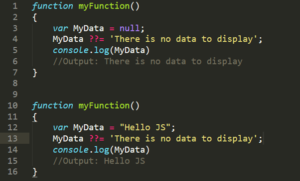

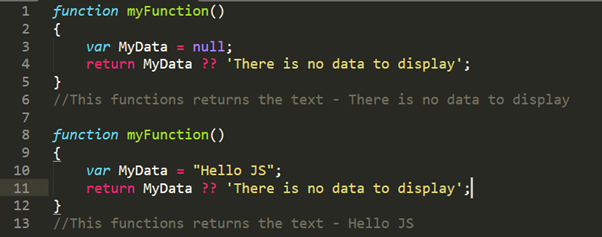

1. ?? Operator

The Nullish Coalescing Operator is a logical operator that handles nullable scenarios. It returns the right hand side operand when its left hand side operand is null or undefined. If the left hand side operand is not null or undefined, it returns the left hand side operand.

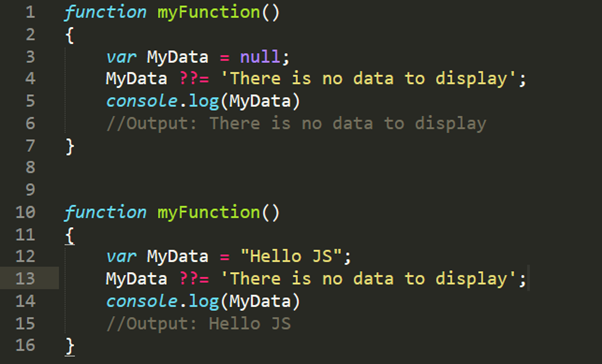

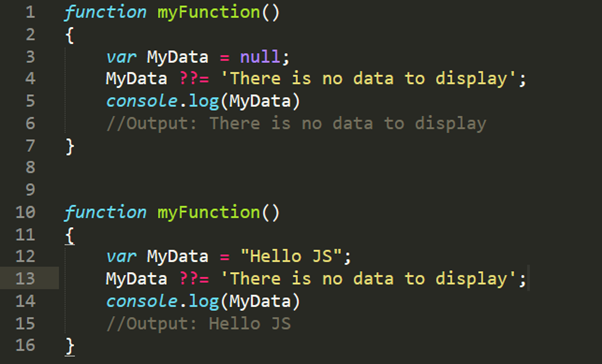

2. ??= Operator

The Nullish Assignment (x??=y)Operator only assigns if x is null or undefined.

3. ??. Operator

The Optional Chaining Operator functions similarly to the . Chaining Operator, except that instead of causing an error if a reference is nullish (null or undefined).

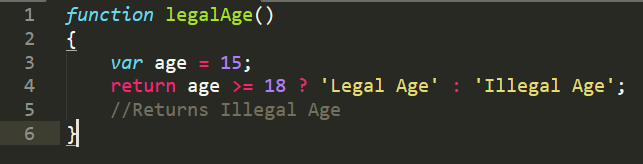

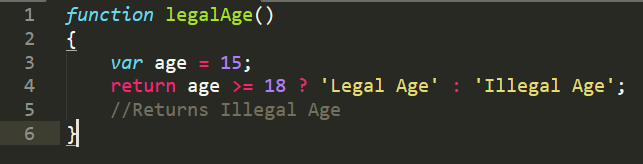

4. ? Operator

The ternary operator ? takes three operands: a condition, an expression to execute if the condition is true, and an expression to execute if the condition is false.

Hope you enjoyed! You can reference more operators and inbuilt functions at the link provided below.

Happy Coding

Get insights to stay ahead in lending industry

Insights delivered monthly !

Subscribe

Fidelity launches US securities lending platform

U.S. asset management giant Fidelity Investments is opening its internal securities lending platform to third-party asset managers and financial institutions.

The Boston-based firm said Fidelity Agency Lending, which served as securities lending agent for its in-house mutual funds since 2019, would now be available to the wider industry.

The service has helped generate added returns for Fidelity’s own funds, the firm said.

“Current market dynamics are compelling institutions to take a more active role in their securities lending programs to find a competitive advantage,” said Justin Aldridge, head of Fidelity Agency Lending, in a release.

“We believe firms are looking for an agent lender with both new technology and the proven ability to serve large, complex institutions, and we’re excited to offer that to the marketplace.”

Planix wins RegTech of the year in US Fintech Awards 2021

Planixs, the leading provider of real-time cash, collateral and liquidity management solutions to global financial services firms, is delighted to announce that it has won the RegTech of the Year award in the US FinTech Awards 2021.

The award recognises Planixs as a leader in the US RegTech space and its real-time treasury software, Realiti®, as the most innovative regulatory solution in the US market.

Founded in 2011, Planixs works with some of the world’s most prestigious global financial institutions such as Santander, Allied Irish Bank, Scotiabank, SIX Group, Banque Internationale à Luxembourg (BIL), Landesbank Baden-Württemberg (LBBW), Lloyds Banking Group and Zenith Bank, in helping them manage their cash and liquidity and address regulatory challenges.

Realiti provides firms with instant, real-time visibility and insight, allowing them to optimise their cash and liquidity and comply with regulatory requirements. With Realiti, organisations can ensure they meet global regulations including the FED, European Banking Authority and UK PRA regulations. The solution also incorporates stress testing capabilities, allowing banking firms to apply a range of stress scenarios in order to understand, monitor and prepare to mitigate any intraday liquidity stresses and to help size liquidity buffers.

Realiti is pivotal in driving operational savings and improving risk management for banks and financial institutions by ensuring they gain real-time liquidity control and ensure regulatory compliance.

The US FinTech Awards, organised by FinTech Intel to celebrate the achievements of the US’s best and brightest FinTech firms, were held virtually on 27th April. In announcing the award, the judges commented that, “Planixs is solving a really difficult issue tracking liquidity in real time and has demonstrated the quality and effectiveness of its solution by securing many large institutional banks as clients.”

Neville Roberts, Planixs’ CEO commented, “It’s an honour to win the US RegTech of the Year and to be recognised for our innovative real-time treasury software. The US is a key market for us and we are working with many US-based banking firms and financial institutions to help them gain real-time insight into their data and improve regulatory compliance over their cash, collateral and liquidity operations – and we look forward to working with many more in the future.”

CU Business Group launches partnership with Community Capital to provide Online Marketplace for Credt Unions

CU Business Group, LLC (“CUBG”), the nation’s largest business services Credit Union Service Organization (“CUSO”), announced it has partnered with Community Capital Technology Inc. (“Community Capital”) to leverage the firm’s online loan marketplace and business intelligence platform to provide a better, more efficient way for their credit union clients to optimize their loan portfolios.

The CUBG Loan Marketplace will enable credit unions to more easily place and source quality commercial loan participations, as well as find and connect to other credit opportunities and capital partners. Whether the credit union is a seller looking to improve ROA, decrease loan to share ratios, or reduce asset concentrations ‒ or a buyer seeking to diversify asset classes or access a broader range of deal flow, CUBG’s exclusive digital community will provide a seamless solution for managing commercial loan balance sheet risk and returns.

“Our team is always exploring new opportunities to leverage the latest service and technology solutions to grow our business and deliver real value to credit unions,” said Larry Middleman, President and CEO of CUBG. “This partnership with Community Capital is reflective of our ongoing commitment to innovation and finding easier, smarter ways to help credit unions more effectively manage their commercial loan portfolios and achieve their strategic goals.”

“We are excited to partner with such a forward-looking company that understands the unique needs of credit unions. By providing both an intuitive, best-in-class digital platform to manage loan participations and expanded deal flow access, this partnership will enable us to significantly scale our participations program to better serve our credit union clients’ growing demand,” said Dexter De Mesa, Vice President of Strategic Initiatives for CUBG.

CEO and Founder of Community Capital, Garrett Smith, added, “We are delighted to be working with the CUBG team, who shares our passion for using new technologies to provide near-term, high-impact solutions for clients. The CUBG Loan Marketplace delivers on our mission to transform how community-based financial institutions manage liquidity and grow their loan portfolios through enhanced deal sourcing, decision-making intelligence, and streamlined transactions. Now more than ever, providing cost-effective tools for efficient balance sheet management is essential for these institutions who serve as critical sources of capital for communities and businesses nationwide.”

Smith continued, “As we continue to rapidly expand our ecosystem of institutions across the U.S., this partnership with CUBG – and their growing network of more than 600 credit unions – demonstrates our deep commitment to the community financial sector and the important role we can play in providing industry-leading liquidity management solutions.”

Events

The 2021 US Fintech Symposium

23-24 Sep 2021, University of Illinois at Chicago

Key Stats

Central Bank Interest Rates and Current Libor Rates

| GBP Libor (overnight) | Interest (09-03-2021) | Central Banks | Interest Rates |

| Euro Libor | -0.58143% | American Interest rate (FED) | 0.25% |

| USD Libor | 0.07725% | Australian Interest rate (RBA) | 0.10% |

| CHF Libor | -0.79960% | British Interest Rate (BoE) | 0.10% |

| JPY Libor | -0.07700% | Canadian Interest Rate (BOC) | 0.25% |

| GBP Libor | 0.04025 % | Japanese Interest Rate (BoJ) | -0.10% |

Contact Us