In the rapidly evolving landscape of financial services, embracing cloud migration emerges as a transformative strategy for lenders seeking to propel their loan origination systems (LOS) into the future. At Insight Consultants, we understand the pivotal role that cloud migration plays in revolutionizing lending operations.

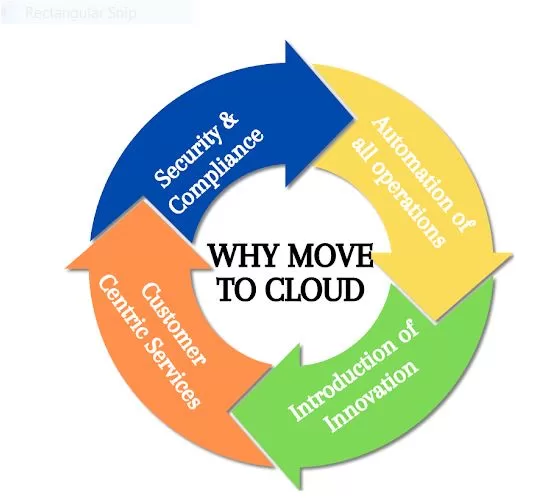

Embracing the cloud revolutionizes business operations, enabling agility and fostering innovation in today’s dynamic landscape. However, many organizations have yet to realize the full potential of their cloud endeavors.

Our expertise lies in guiding you through every step of your cloud journey, from adoption to optimization, ensuring maximum value from your investment. Whether you require financial optimization, governance, management, or security assistance, we have the tools and capabilities to meet your requirements.

Empower your Business with Insight Comprehensive Cloud Solution

Let’s dive deeper into how Insight Consultants can be your trusted partner throughout your cloud journey. We offer a comprehensive suite of services designed to meet your specific needs, from crafting a hybrid cloud strategy to managing your cloud-based applications.

Cloud Capabilities

Hybrid Cloud Strategy:

- Assessment of current infrastructure and business needs

- Designing a hybrid cloud architecture tailored to your requirements

- Implementation of hybrid cloud solutions, including private and public cloud integration

- Migration planning and execution for workload optimization

- Continuous monitoring and optimization of hybrid cloud environment

Application Migration and Modernization:

- Assessment of existing applications for migration needs

- Planning and execution of application migration to cloud environments

- Refactoring and modernization of legacy applications for cloud compatibility

- Integration of cloud-native features and services to enhance application functionality

- Testing and validation of migrated applications for performance and reliability

Cloud Application Development:

- Custom application development tailored to cloud environments

- Utilization of cloud-native technologies and architectures for scalability and flexibility

- Rapid prototyping and iterative development methodologies

- Integration with existing systems and third-party services through APIs

- Continuous deployment and DevOps practices for seamless delivery

Application Management Service:

- Monitoring and performance optimization of cloud-based applications

- Proactive maintenance and troubleshooting to ensure application availability

- Security management, including data protection and access control

- Compliance management to adhere to industry regulations and standards

- Regular reporting and analysis to track application performance and usage

Benefits of Cloud Migration in LMS

By leveraging our expertise, you can achieve the following advantages for your cloud-based LMS (Loan Management system)

- Accelerated Loan Processing: Cloud-based LOS speeds up loan processing, reducing turnaround times.

- Automated Workflows: Cloud automation tools optimize workflows, minimizing manual tasks and enhancing efficiency.

- Real-time Data Access: Cloud migration enables instant access to critical borrower data, improving decision-making.

- Scalable Infrastructure: Cloud resources offer dynamic allocation for seamless scalability to meet fluctuating demands.

- Enhanced Security: Cloud providers offer robust security features, including encryption and threat detection, ensuring data protection.

Insight Cloud-Based Loan Management Optimization

The enhanced scalability and flexibility of the cloud can be maximized with our Insight Loan Optimization Services, ensuring your loan origination process runs at peak efficiency.

- Secure Data Storage for Sensitive Information: Utilize Azure-native database services such as Azure SQL Database to securely and compliantly store sensitive customer data.

- Secure Storage for Loan Agreements: Employ Azure Blob Storage to store loan agreements and associated documents.

- Application Performance Monitoring: Leverage tools like Azure Application Insights to monitor and analyze the performance of the loan origination application in real-time.

- Loan Processing Automation: Utilize Azure Logic Apps or Azure Functions to automate loan processing workflows, reducing manual intervention and improving efficiency.

Why Choose Insight for Your Cloud Journey

- Certified Cloud Experts: Ensuring precision with certified professionals.

- Multi-Cloud Proficiency: Harnessing Azure, AWS, and Google Cloud.

- Decades of Experience: Over 10+ years of cloud mastery.

- Proven Track Record: Delivering excellence in every project.

Get in touch with us to know more about cloud migration or for expert assistance in devising your cloud migration strategy.