Re-designing of Loan Origination Application, twice as fast as its previous version,for the Client ‘Open Road’.

Category: Latest Posts

Regulatory Risks Hindering Operations?

Ever feel like the regulatory landscape is shifting beneath your feet? You’re not alone. The surge in compliance regulations is hitting lenders hard, especially the smaller players. But fear not – we’ve got your back. Handling compliance risks requires finesse, and that’s where we come in. At Insight, we don’t just understand the game;… Continue reading Regulatory Risks Hindering Operations?

Facing Operational Efficiency Challenges in Loan Processing?

Are you somebody facing this problem? Lending firms often find themselves grappling with a common hurdle in today’s ever-evolving lending landscape: operational efficiency challenges that can impede loan growth. The cumbersome nature of loan origination, coupled with regulatory complexities and increasing customer demands, can lead to operational bottlenecks, higher costs,and a compromised borrower experience.… Continue reading Facing Operational Efficiency Challenges in Loan Processing?

Streamline Loan Cycles With Insight Consultants

An efficient Loan Origination Solution can streamline your processes, reduce costs, and enhance customer satisfaction. It’s not just about managing loans; it’s about transforming and streamlining your entire loan lifecycle and driving business growth. Insight Consultants comprehensive loan origination services are designed to empower lenders unique needs. Lorem ipsum dolor sit amet, consectetur… Continue reading Streamline Loan Cycles With Insight Consultants

Future of Lending: Insights and Innovations.

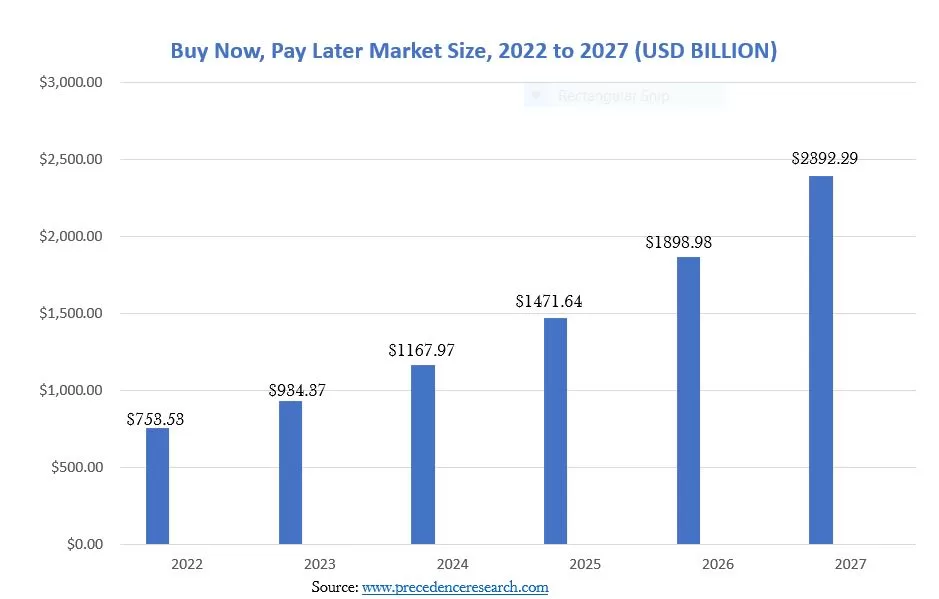

As we anticipate the future of lending in 2024, the financial landscape brims with exciting trends set to revolutionize our banking experiences. The expanding lending market places a strong emphasis on responsible lending and sustainable practices, projecting unprecedented heights for the future of lending in the coming year. Navigating the future of lending … Continue reading Future of Lending: Insights and Innovations.

Turning Risk to Revenue: The Path to Enhanced Profitability

In finance, where every decision can tip the scales between success and setbacks. One key factor often goes unnoticed until it’s too late: Credit Risk Management. For businesses, efficient credit risk management is the linchpin holding profitability andgrowth in perfect balance. With the ever-changing economic landscape, it has become increasingly important for financial institutions and… Continue reading Turning Risk to Revenue: The Path to Enhanced Profitability

How Data Analytics is Transforming the CPA Profession

Understand today’s prevalent digital payment systems and emerging fraud tactics targeting them. Explore techniques CPAs use for fraud detection and best practices to protect clients as payment technologies and risks evolve.

Efficient Loan Origination: Fueling Community Bank Growth

Understand today’s prevalent digital payment systems and emerging fraud tactics targeting them. Explore techniques CPAs use for fraud detection and best practices to protect clients as payment technologies and risks evolve.