The LendTech Collective

Insights to stay ahead!

Bimonthly Newsletter | Nov 2022 | Issue 121

Featuring

- Christmas Loan- should you consider borrow one for Christmas spending?

- Loan default risk prevention and management in economic uncertainty-tips to lenders

- In the News

- Major Events

-

Focus On

Christmas Loan – Should you consider borrow one for holiday spending?

As the holidays approach, many people find themselves in a financial bind. If you’re among them, you might be considering a loan to get you through the season. As you explore your options for Christmas gifts and travel, you may come across lenders advertising “Christmas loans”—though these offers should be approached with caution. Should you get one this holiday season?

What is Christmas Loan and how does it work?

A festival loan is a type of personal loan offered by online lenders and credit unions during the festival season. It can be a secured or unsecured loan, depending on the lender’s requirements. Borrowers’ terms and eligibility are determined by a variety of factors that vary by lender, including credit and income. To receive the most competitive interest rates, borrowers need to have good credit scores.

Some lenders require a minimum credit score, whereas others don’t check your credit at all. Lenders that don’t require a credit check typically charge high rates. In fact, these no-credit-check Christmas loans are essentially payday loans with fees equivalent to interest rates of 400% or higher.

If you decide to take out a Christmas loan, it’s important to shop around for lenders and find the one that’s right for you.

Are Christmas Loan worth it?

A Christmas loan can relieve some financial stress and give you some peace of mind this holiday season. At the same time, though these loans are often easy to obtain and fast to process, they don’t provide a long-term solution. The Consumer Financial Protection Bureau (CFPB) states that consumers who take out an unaffordable payday loan often end up taking out another one to pay it back, thereby getting stuck in a debt trap.

Things to consider while shopping for a Christmas loan

Check your credit: Before taking out a loan, it’s useful to know what your credit score is and what’s on your credit report. The stronger your credit, the better rate you’ll likely get on a loan.

Keep up with payments: Christmas loans are instalment loans, and you will need to plan for this in your budget and be sure you can afford the payments.

Fast funding option: If you choose an online lender, generally the application and funding process is quick and easy and can receive the loan the same business day.

Check multiple lenders: Compare multiple options before choosing a lender so you can find the best rates and terms.

Pros and cons of Christmas loans

Before getting a Christmas loan to cover your holiday spending, consider these pros and cons

Pros

- Fast funding

- Some loans don’t require a credit check

- Short-term loans with fixed payment line

- Fast and simple loan application

Cons

- Potentially high interest rates

- May be a payday loan

- Could lose collateral

- .Expensive fees

Nutshell

If you find yourself spending more than you can afford, try taking out a Christmas loan. However, before you take on debt, it’s important to understand the potential risks, like high fees and interest. If you find yourself spending past your means, check back in with your budget as a reminder of what you can afford this year. By setting limits upfront, you may be able to make it through the holiday season without carrying debt into the new year.

Keep Reading

Loan default risk prevention and management in economic uncertainty

This is a time of great uncertainty for our economies. Policy makers, economists, and financial-market participants fiercely debated the higher inflation is under way. In the past year and next, inflation has risen above expectations. Experts say that annual price increases of around 2% are likely to continue for the foreseeable future. Due to Russia’s invasion of Ukraine and the resulting disruptions in energy, agriculture, and mining markets, inflation is expected to be higher-than-normal.

How inflation affects direct lenders

Inflation has an important impact on lending and credit risk management because it affects the price of assets, which in turn affects loan defaults and credit risk analysis.

With such financial distress, coupled with consumers’ need to save during difficult times, we are seeing a concerning uptick in loan defaults and credit risk. Direct lenders have experienced the highest number of loans that have gone into default—putting pressure on these smaller banks. For first-time borrowers whose credit scores haven’t caught up, evaluating them adds extra headache to direct lenders.

Lenders are in a challenging position: how can they better mitigate loan default risks?

Let’s look at some of the top credit risk challenges that lenders are facing during this period of inflation and how they can get around them.

inefficient credit risk analysis: Analyzing a customer’s credit risk—segmenting customers, identifying potential first-time defaulters, and flagging recurrent defaulters—is inefficient and error prone when done manually.

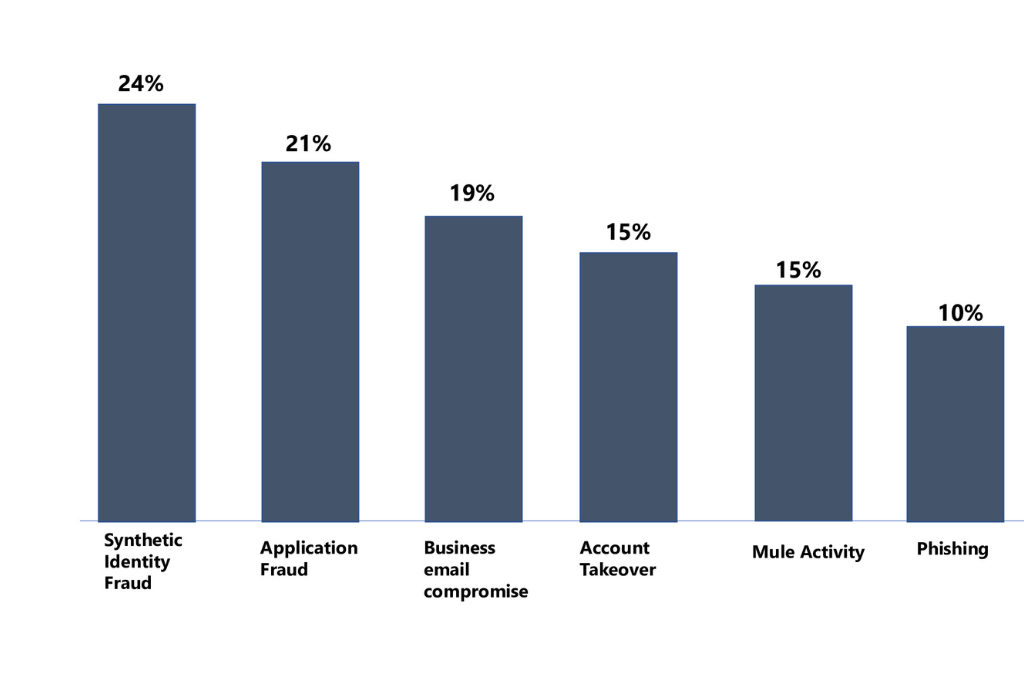

No proper fraud detection framework: Fraudulent debit and credit transactions, as well as loan stacking, are common sources of document fraud. Requesting a borrower’s last several months’ worth of bank statements is time-consuming and tedious—and fraught with risk.

Unable to accurately determine the probability of default (POD) :Lenders need a more efficient and effective way to accurately determine a borrower’s POD and the likelihood of repaying loans, so that lenders can calculate credit risk and estimate the expected loan losses. This requires a holistic understanding of a borrower’s debt-to-income ratio and credit score.

Navigating Inflation

To keep up with new realities, businesses must redesign their products and services. Digital lending must happen on a large scale—and lenders need sustainable technology to support the digital transformation of credit risk management. Digital risk profiling and modeling can help to reduce defaults by giving lenders a deeper understanding of the people they lend money to. This approach helps them to identify non-eligible applicants earlier, reducing exposure in case any fraud happens later.

To compete and retain customers, lenders need to rethink the way they do business. They must anticipate customer needs and offer a seamless digital experience that exceeds expectations.

Get insights to stay ahead in lending industry

Insights delivered monthly !

Subscribe

In the News

Credit Unions register record high auto market share

With the onset of the chip shortage, captive lenders began to recede from the heavy incentives that kept sales going in the early days of the pandemic. When coupled with rising vehicle prices and interest rates, this created a unique opportunity for credit unions to achieve their highest market share in history, as they remain one of the few lenders still offering lower interest rates.

According to Experian’s “State of the Automotive Finance Market Report: Q2 2022,” credit unions’ market share increased to 25.81%, from 18.32% in Q2 2021. In comparison, captives decreased to 22.64% this quarter, from 28.47% the previous year.

This was the highest increase of total market share credit unions have ever experienced – going from 22.38% in Q2 2018 to 19.97% in Q2 2019 and 18.63% in Q2 2020.

Breaking down the data further, credit unions saw the largest growth across both new and used vehicle market share. In Q2 2022, credit unions’ new vehicle market share increased to 26.69%, from 15.27% in Q2 2021 and went from 23.49% to 28.62% year-over-year in used vehicle market share.

Meanwhile, captives’ new vehicle market share decreased from 44.88% in Q2 2021 to 36.29% in Q2 2022 and their used vehicle market share came in at 7.89% this quarter, from 8.51% the previous year.

Even as inventory shortages and other economic hardships remain prominent throughout the automotive industry, captives are pulling back on traditionally heavy incentives and seemingly continue to offer higher interest rates than other lenders – resulting in their market share decline. This contrasts with credit unions, who have historically been known to offer lower rates.

Lower Interest Rates Enable Potential Market Share Gain

While vehicle prices continue to increase, consumers appear to be searching for financing options that may alleviate the rising average monthly payment – making it important for lenders to analyze these trends and gain better insight into why the market may be shifting.

For instance, when comparing lender types in Q2 2022, credit unions offered an average new loan rate of 3.72% and average used loan rate of 5.24%. Meanwhile, captives had higher rates, coming in at 4.18% for an average new loan rate and 8.18% for an average used loan rate.

Analyzing past lender loan rates shows that captives increased their rates year-over-year while credit unions have remained fairly steady. In Q2 2021, the average new loan rate for captives came in at 3.44% and their used loan rate was 7.48%. In the same time frame, credit unions had an average new loan rate of 3.87% and an average used loan rate of 5.21%.

As consumers look into different lenders when searching to finance a vehicle, it is important for professionals to know whether they are interested in a new or used vehicle – since interest rates can majorly impact the average monthly payments.

Vehicle Financing Trends

While credit unions typically focus on the used car space rather than new, the sharp increase in their new vehicle market share this quarter indicates they may also be directing their attention to the new car space.

Although, with consumers continuing to opt for used vehicles as they search for the most budget-friendly option, credit unions have a number of opportunities to sustain growth in both new and used market share – since the used vehicle financing comprised more than half of the total finance market.

In Q2 2022, used vehicle financing came in at 61.78%, from 58.48% the previous year. While new vehicle financing made up 38.22% of the total finance market, a decrease from 41.52% in Q2 2021. It’s not out of the ordinary for consumers to prefer used vehicles, seeing there was a noteworthy difference in the average monthly payments this quarter. For instance, the average monthly payment for a used vehicle went from $440 in Q2 2021 to $515 in Q2 2022 – compared to the average monthly payment for a new vehicle, which hit a record high of $667 this quarter, up from $582 the previous year.

While the increase in used vehicle financing can have a positive impact on credit unions’ market share gain, analyzing multiple data points will enable the lender to properly assist consumers when finding a vehicle that meets their financial needs and create more opportunities for continued market share growth.

Consumer spending remains high despite inflation

ACI Worldwide’s e-commerce research shows that consumer optimism is holding strong, despite inflationary pressures and limited inventory, and beat last year’s predictions for the same period (14 per cent). “Consumers are quietly optimistic with their holiday season spending but will be more price-conscious this year as inflation and economic uncertainty loom,” said head of merchant, ACI Worldwide. “We’re seeing shoppers spend more on experiences rather than physical items as pent-up demand for travel, events and concerts remains strong post covid.”

ACI’s e-commerce intelligence reports that the main sector driving growth during the 2022 holiday season will be gaming (34 per cent). Travel and ticketing (29 per cent) take second place, telco (18 per cent) third, home improvement (13 per cent) fourth and fashion retail (seven per cent) fifth.

Mobile Payments slightly increase and preference for digital wallets grows

Mobile payments are projected to increase five per cent during the 2022 holiday season, compared to the same period in 2021, while the average ticket value (ATV) is expected to grow by 45 per cent ($123), according to ACI e-commerce intelligence. Moreover, digital wallets are anticipated to be among the popular payment methods, with a projected 11 percent increase in transactions.

The ATV for buy now, pay later (BNPL) is expected to grow 10 per cent. As inventory shortages persist, ACI forecasts a revival of the gift card industry with an expected two times increase in ATV. Furthermore, spending within the gaming sector is predicted to rise 34 percent in transaction volume.

“Consumers are savvier on payment methods like BNPL as they look to delay spending by breaking up their purchases into smaller installments,” Singh continued. “In addition, consumers are showing a strong preference for digital wallets as a payment method as they shop more online and less in stores this holiday season.

“Merchants may want to consider improving the BNPL checkout experience for people with higher credit-approval rates. In addition, ensuring a smooth experience with digital wallet acceptance and strong fraud prevention in place will be beneficial.”

As merchants instil shipment cut off dates for last-minute shoppers, the volume of transactions is expected to increase 24 per cent for shipment cut off: priority, 15 per cent for shipment cut off: ground and 10 per cent for shipment cutoff: express.

However, buy online, pick up in store (BOPIS) is forecasted to go up nine per cent during the 2022 holiday season compared to 2021, as consumers consider this alternative to paying for shipping. “With inflation driving shipment costs up, we can expect to see shoppers turning to other delivery channels like BOPIS to curb their expenses,” Singh concluded.

Fraudsters targeting high-value items

According to ACI data, the volume of friendly fraud increased 22 per cent. The data also found the average transaction value grew 39 per cent from January through September 2022, when compared to the same period in 2021. The data also shows that account takeover fraud doubled in the same time frame versus 2021.

“We’re seeing a significant increase in the average ticket value of friendly fraud. This indicates that fraudsters are targeting high-value items like electronics and travel,” said Erika Dietrich, head of fraud management and payments analytics, ACI Worldwide. “We expect this trend to continue into the 2022 holiday season and encourage merchants and shoppers to be vigilant.

US mortgage rate tops 7% for the first time in 2 decades

Average long-term U.S. mortgage rates topped 7% for the first time in more than two decades this week, a result of the Federal Reserve’s aggressive rate hikes intended to tame inflation not seen in some 40 years. Last year at this time, rates on a 30-year mortgage averaged 3.14%.

Higher mortgage rates reduce homebuyers’ purchasing power, resulting in fewer people being able to afford to buy a home at a time when home prices continue to climb, albeit more slowly than earlier this year. The combination of higher rates and home prices means a typical mortgage payment for a homebuyer is up hundreds of dollars compared to what it was earlier this year.

“We’re really viewing this as a spike in mortgage rates that is pretty dramatically impacting affordability in the market, really sharply curtailing demand,” said Mike Fratantoni, chief economist at the Mortgage Bankers Association.

The last time the average rate was above 7% was April 2002, a time when the U.S. was still reeling from the Sept. 11 terrorist attacks, but six years away from the 2008 housing market collapse that triggered the Great Recession.

Many potential homebuyers have moved to the sidelines as mortgage rates have more than doubled this year, a trend that’s knocked the once red-hot housing market into a slump.

Sales of existing homes have declined for eight straight months as borrowing costs have become too high a hurdle for many Americans already paying more for food, gas and other necessities. Meanwhile, some homeowners have held off putting their homes on the market because they don’t want to jump into a higher rate on their next mortgage.

In effort to tamp down inflation, which is the highest in four decades, the Fed has raised its key benchmark lending rate five times this year, including three consecutive 0.75 percentage point increases that have brought its key short-term borrowing rate to a range of 3% to 3.25%, the highest level since 2008. At their last meeting in late September, Fed officials projected that by early next year they would raise their key rate to roughly 4.5%.

Despite the rate increases inflation has hardly budged, remaining above 8% at both the consumer and wholesale level.

Even as the housing market slows considerably, the job market remains strong and consumer spending is resilient. The Fed is expected to raise its benchmark rate another three-quarters of a point when it meets next week.

While mortgage rates don’t necessarily mirror the Fed’s rate increases, they tend to track the yield on the 10-year Treasury note. The yield is influenced by a variety of factors, including investors’ expectations for future inflation and global demand for U.S. Treasurys.

The monthly payment on a median priced home is 78% higher now than it was a year ago for buyers who can make a 20% down payment. This translates to a $1,000 increase in the typical home payment in just the last year, according to Realtor.com.

To cope, some homebuyers are opting for adjustable-rate mortgages, which don’t make it any easier to qualify for financing but offer lower monthly payments in the first few years of the loan term. Such loans became less attractive the last couple of years as average long-term mortgage rates fell to an all-time low. But as of August they made up about 20% of home loan originations, said Selma Hepp, chief economist at CoreLogic.

Events

Money 2.0 Conference USA

19-21, December 2022

3950, Las Vegas, Blvd S, US

Insight Consultants are focused on making level the rough roads that exist in the lending industry. We serve customers globally from our offices in the US and India.

Contact us