Before we dive deep into the topic. We need to get this out of the way. What do you call a team that is not working from the same location? Remote Team or Virtual Team Drumroll, please…. According to Google, the term used more often is ‘Virtual Team’ with almost close to 2400 searches monthly.‘Remote… Continue reading How to Build an All-Star Virtual Team

Month: June 2020

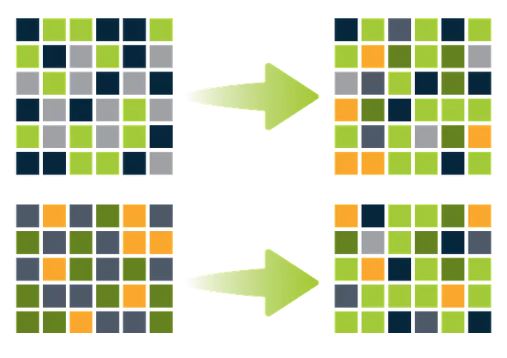

Automated Reconciliation: Reconcile with confidence

Reconciliation is a critical component of financial services. Data Reconciliation describes the method of verifying and validating data collected from multiple systems, and is required to ensure that data is properly consumed by transactional systems while preventing any potential loss of information. But, reconciliation at many firms remains a laborious, time-consuming and risk-laden process,… Continue reading Automated Reconciliation: Reconcile with confidence

The Role of big data in Finance & Accounting

Did you know this? The NYSE trade data for a day is almost a TB! Well if you think that’s big, FB accumulates 500+ TB a day! And if you think that’s big, a single jet engine collects 10 TB but in 30 minutes! Be it Google Ads, LinkedIn or even roadside posters, you would… Continue reading The Role of big data in Finance & Accounting

Fire and Forget

— Asynchronous over Synchronous Have you encountered any performance issues recently? Is the spinning icon troubling you? Any timeout errors that you wish you could solve? Well, I found answers to some of these issues using Asynchronous Requests. Before we move further on how asynchronous requests can handle all the above issues, let me give… Continue reading Fire and Forget

How can Artificial Intelligence (AI) help Lenders adapt and grow?

For the lending sector, protecting the stability of the organization and to reduce credit exposure are the biggest concerns during the pandemic. This has emphasized lenders on the critical importance of Artificial Intelligence and Machine Learning solutions that enable speed, flexibility, insight and innovation. AI-powered capabilities and services can help firms automate their IT infrastructures… Continue reading How can Artificial Intelligence (AI) help Lenders adapt and grow?

MS Intune — Advanced Data Security and Device Management over the Internet

To avoid the data leakage of any company and protect it from hackers (including data collecting software without notifying the user) we have a lot of technologies to follow and incorporate. However, what about a company’s internal data security? How can we protect data from being misused by any internal employee? Microsoft Intune is the… Continue reading MS Intune — Advanced Data Security and Device Management over the Internet