Key Takeaways

- BNPL’s rapid growth draws regulatory focus on financial compliance, safeguarding consumer rights, privacy, and economic well-being.

- BNPL regulations differ by country; focus includes transparency, responsible lending, credit assessments, data privacy, and anti-money laundering.

- BNPL providers must expect upcoming regulations, engage in dialogue, enhance compliance, and adapt to diverse frameworks for successful navigation.

Growing concerns and need for regulatory compliance in BNPL space

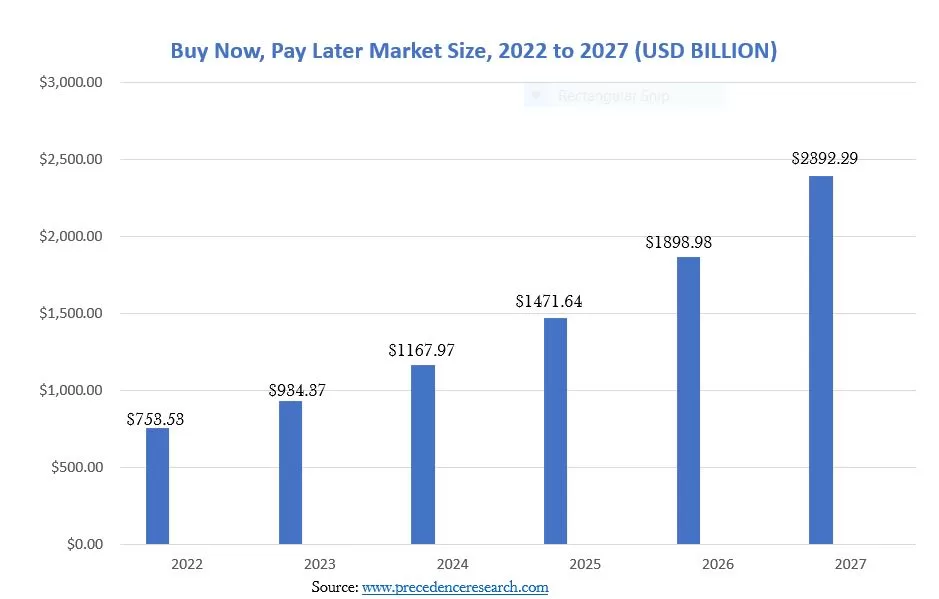

The BNPL industry has significantly expanded from 2019 to 2021. There was an astonishing 970% surge in the loans issued by BNPL lenders. Also, BNPL users quadruple.

Buy Now Pay Later (BNPL) has experienced an explosive surge in popularity thanks to its convenience, absence of interest rates, and streamlined approval process. Nevertheless, as BNPL gains traction, the importance of financial compliance within the industry has grown. With more consumers embracing this payment option, there is a pressing need to ensure adequate measures are in place to protect consumer rights, privacy, and financial well-being. As a result, regulators increasingly focus on establishing guidelines and standards to address transparency, fair lending practices, responsible lending, and anti-money laundering measures in the BNPL space. Striking the right balance between innovation and regulation is essential to foster consumer trust, maintain financial stability, and promote sustainable growth in this evolving sector. Overall, BNPL’s popularity calls for a cautious approach that prioritizes both customer convenience and protection.

Regulatory Landscape of the BNPL Industry

In virtually every country where Buy Now, Pay Later is offered as a payment method, it is commonly observed that BNPL is excluded from local laws and regulations.

As fintech businesses increasingly adopt Buy Now, Pay Later (BNPL) models, staying abreast of the latest BNPL regulatory changes and requirements becomes paramount. However, the regulatory landscape for BNPL varies across countries, with each area adopting its approach to address the unique challenges associated with these services. The Consumer Financial Protection Bureau (CFPB) has taken the lead in spearheading BNPL regulation in the United States.

Acknowledging the inherent risks associated with BNPL as a financing solution, the CFPB recently conducted a study highlighting the dangers consumers may encounter, including debt accumulation, overextension, and unauthorized harvesting of user data by BNPL providers. As a result of these findings, the specifics of forthcoming regulations are still unknown; however, industry experts anticipate the CFPB will soon unveil proposed rules. In an effort to address these concerns, anticipated regulations aim to align BNPL within the existing regulatory framework governing traditional credit companies, imposing comparable guidelines and restrictions on BNPL providers. This move comes as a means to protect consumers and ensure responsible lending practices across the industry.

Key Areas of Regulatory Scrutiny

Regulators closely examine the clarity and adequacy of disclosures provided by BNPL providers. The aim is to ensure consumers understand their financial obligations and the costs of using BNPL services.

Regulators stress responsible lending in the BNPL industry, focusing on affordability assessments and consumer protection.

Scrutinize credit assessment and underwriting in the BNPL sector, evaluating accuracy, suitability, and risk management practices.

BNPL providers are expected to comply with relevant data protection regulations, implement robust data security measures, and ensure proper consent and transparency regarding the use of customer data.

Focus on verifying customer identities, monitoring transactions for suspicious activity, and implementing measures to mitigate the risk of fraud and money laundering.

Future Ahead: Challenges to Face and Actions to Take by BNPL Providers

Until now, small, emerging fintech companies have dominated the BNPL space, managing to avoid substantial regulatory scrutiny. However, this landscape is on the brink of transformation. Despite the absence of concrete regulations thus far, which has facilitated the growth of the BNPL industry, a transitional phase is imminent. Consequently, BNPL service providers will soon face the realization of navigating a market governed by diverse regulatory regimes and varying operational approaches. In light of this upcoming shift, heightened awareness of the complexities involved in complying with regulations and adapting to different regulatory frameworks will become essential.

Major challenges

Regulators increase scrutiny

The federal financial regulatory agencies, including the CFPB, strongly focus on consumer protection. As a result, these regulatory efforts demand heightened compliance measures, stricter adherence to responsible lending practices, and robust consumer protection policies. BNPL providers must proactively invest resources and expertise to meet evolving regulatory requirements. This includes navigating complex compliance frameworks and addressing potential gaps or vulnerabilities. By doing so, BNPL companies can ensure they align with the regulatory landscape while maintaining a commitment to safeguarding consumer interests.

Increased Competition

BNPL providers struggle to differentiate in a crowded market where digital upstarts and legacy players launch new products and forge partnerships.

Banking Partners Turning Cautious

If default trends are unfavorable, they may be looking to de-risk their relationships with BNPL providers and reevaluate their role in the BNPL segment. This can result in stricter lending criteria, reduced funding opportunities, or even reconsidering their involvement in the BNPL segment altogether.

Bureau Reporting wake-up call

With major credit reporting agencies incorporating BNPL data into credit reports, the potential credit impacts of delinquent BNPL loans will become more visible to lenders and financial institutions. As a result, this heightened visibility can influence consumer behaviors, as individuals may become more cautious about their BNPL usage and repayment habits to avoid negative credit report impacts. Consequently, BNPL providers may experience a shift in customer behavior, with users adopting more responsible borrowing practices. Moreover, this increased visibility may subject BNPL providers to greater scrutiny from lenders and financial institutions with access to additional data points to assess borrowers’ creditworthiness. As a potential consequence, BNPL providers may also face the challenge of managing potentially higher default rates, prompting them to prioritize responsible lending and risk assessment strategies further.

Act now to tackle challenges

- Establish a comprehensive compliance framework aligned with regulatory requirements. This includes implementing policies, procedures, and internal controls that ensure adherence to consumer protection laws, responsible lending practices, and data privacy regulations.

- Differentiate themselves by focusing on innovative product offerings, enhancing customer experience through personalized services, and fostering strategic partnerships to expand their market reach and stand out in the crowded BNPL landscape.

- Create a regulatory strategy that allows for the growth of your risk management and compliance programs as your BNPL portfolio grows. Strengthen affordability assessments to evaluate a consumer’s loan repayment ability accurately. Consider income verification, creditworthiness checks, and other relevant factors to mitigate over-indebtedness risk.

- Prioritize responsible lending practices, implement robust credit risk assessment processes, and offer customers proactive financial education and support.

Proactive Compliance is Key for BNPL Players

While there’s no specific BNPL regulation today, there are frameworks both at the federal and state level for consumer-facing products that can be used to examine and enforce companies offering BNPL products. As a result, compliance and legal teams should be proactive and build out processes now to prepare for inevitable BNPL regulation and get out ahead of regulatory scrutiny.

Moving forward, Buy Now, Pay Later greatly appeals to merchants and consumers as a payment method. However, as the concept evolves and technology advances in the future, the BNPL industry is expected to experience continued growth. Nevertheless, the primary emphasis will now shift towards maintaining compliance with regulatory requirements and prioritizing delivering fair and transparent products that benefit consumers. In doing so, BNPL providers can position themselves for long-term success while fostering trust and confidence among their customer base. By adapting to changing regulatory landscapes and focusing on consumer well-being, the BNPL industry can thrive in an increasingly regulated financial market.

Get Insights to stay ahead in the Lending Industry.

Insights delivered monthly!