Key Takeaways

- Tailored Solutions for Modern Needs: Customized cloud solutions empower businesses to optimize resource allocation, enhance data security, and streamline workflows, providing a strategic edge in today’s competitive market.

- Strategic Deployment for Success: Proactive assessment and planning, coupled with precise design and phased implementation, ensure a seamless transition to hybrid and multi-cloud architectures, maximizing efficiency, security, and market competitiveness.

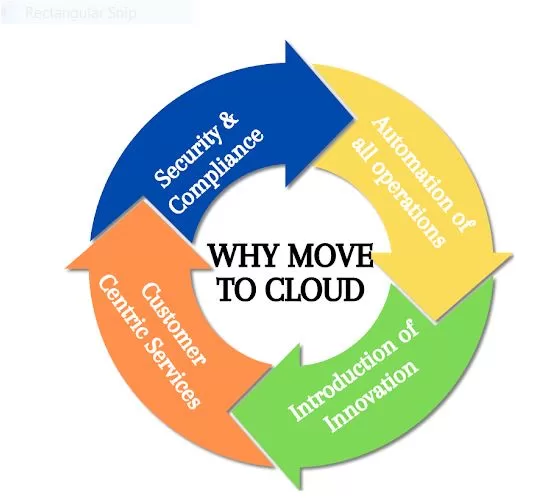

The business landscape is constantly evolving, demanding agility and adaptability. At the forefront of this transformation lies cloud technology. But a one-size-fits-all approach will not do. Modern businesses need cloud solutions tailored to their unique needs and goals.

Customized cloud solutions empower businesses to leverage cloud capabilities while addressing their specific requirements and objectives. Whether it is s optimizing resource allocation, enhancing data security, or streamlining operational workflows, bespoke cloud architectures offer a strategic advantage in today’s competitive market.

Crafting Your Cloud Journey: A Personalized Insight Approach

At Insight, we redefine cloud solutions, moving beyond generic packages to deliver tailored strategies that drive your business forward. Our process begins with a deep dive into your unique needs, goals, and existing infrastructure. From there, we craft a bespoke cloud architecture designed to seamlessly integrate with your operations, ensuring a smooth transition and tangible results.

Our Hybrid and Multi-Cloud Architecture Strategy

A well-defined strategy is crucial for a successful hybrid and multi-cloud architecture implementation. This approach breaks down the process into distinct phases, ensuring a smooth transition and maximizing the benefits of your cloud solution.

Phase 1: Assessment and Planning

- Business Needs Analysis: This phase involves a thorough evaluation of your current IT infrastructure, workloads, data management practices, and security requirements. Understanding your business goals and objectives is critical to tailor the architecture accordingly.

- Cloud Readiness Assessment: This stage assesses your organization’s preparedness for cloud adoption. This includes evaluating your cloud skills, IT tools, and existing security protocols. Any gaps identified can be addressed through training or implementation of necessary tools.

- Workload Distribution Strategy: Here, you categorize your workloads based on their suitability for different cloud environments (public, private, or a combination). Factors like security sensitivity, compliance regulations, and scalability needs will influence these decisions.

- Vendor Selection: Identify and evaluate potential cloud providers based on their service offerings, pricing models, and security certifications that align with your requirements.

Phase 2: Design and Development

- Architecture Design: Based on the assessment phase, design a hybrid and multi-cloud architecture that integrates seamlessly with your on-premises infrastructure. This includes defining network connectivity, data security protocols, and identity management solutions.

- Cloud Infrastructure Provisioning: Provision resources in your chosen cloud environments. This might involve creating virtual machines, storage buckets, and databases according to your workload needs.

- Application Migration and Integration: Develop a migration plan for applications to their designated cloud environments. This could involve a lift-and-shift approach for simple applications or containerization for more complex deployments. Ensure integration between on-premises and cloud-based applications for seamless operation.

- Security Implementation: Implement robust security measures across your hybrid and multi-cloud environment. This includes firewalls, intrusion detection systems, and data encryption to ensure the protection of sensitive information.

Phase 3: Deployment and Management

- Pilot Deployment and Testing: Conduct a pilot deployment of a non-critical application in your cloud environment. This helps identify and address any potential issues before migrating critical workloads.

- Phased Migration: Migrate applications to their designated cloud environments according to the migration plan developed earlier. This phased approach minimizes disruption and ensures a smooth transition.

- Performance Monitoring and Optimization: Continuously monitor the performance of your hybrid and multi-cloud architecture. This includes tracking resource utilization, application performance metrics, and security threats. Use this data to optimize your cloud environment and ensure it meets your evolving business needs.

- Ongoing Management: Our commitment does not end with migration. We provide ongoing maintenance and support to ensure the sustained success of your cloud environment.

By following this phased approach with careful planning, execution, and ongoing management, you can successfully implement a hybrid and multi-cloud architecture that empowers your business with scalability, agility, and cost-efficiency.

Expertise in Action: Success Story from the Cloud

At Insight Consultants, our expertise shines through in real-world success stories like the one experienced by an online lending company. This client, specializing in short-term loans for individuals with limited access to traditional credit, faced the challenge of outdated legacy systems tethered to on-premises infrastructure. Seeking a transformation, they turned to us to usher in a new era of agility and customer-centricity.

We took a comprehensive approach to migrating client’s loan origination system to the cloud, ensuring a seamless transition while maximizing benefits. Our approach began with strategic planning, involving a comprehensive analysis of the client’s requirements. We re-architected the legacy system to embrace the modern cloud era, adopting a microservice architecture for enhanced reliability, scalability, and flexibility.

Post-cloud migration, the client saw remarkable operational and business improvements. Key operational KPIs like uptime, reliability, and loan processing times saw significant enhancements, while compliance adherence strengthened. Meanwhile, the business achieved lower costs per funded loan, reduced customer acquisition expenses, and improved agility in product launches.

Our success story reveals how Insight’s expertise in customized cloud solutions has helped businesses achieve real, tangible results. We are confident that we can do the same for you.

Why Choose Insight for your Cloud Journey

- Certified Cloud Experts: Ensuring precision with accredited professionals

- Multi-Cloud Proficiency: Harnessing Azure, AWS, and Google Cloud

- Decades of Experience: Over 10+ years of cloud mastery

- Proven Track Record: Getting startup projects quickly to market by using agile methodology

Contact us to learn more about the tailored cloud solutions that can significantly influence business growth, agility, innovation, and competitiveness.