Key Takeaways

- Proactive and advanced planning can make cloud deployment easy.

- Evaluating cloud providers and tailoring deployment models to specific needs optimizes efficiency, security, and market competitiveness.

- Cloud scalability is the key to customer satisfaction.

- Cloud computing democratizes IT infrastructure for startups and SMBs, driving accessibility and cost-effectiveness.

Historically, startups and SMBs faced significant hurdles due to the prohibitive costs and complexity of establishing IT infrastructure. However, cloud computing has revolutionized this landscape, providing a more accessible and cost-effective solution. According to a recent report by Colorlib, approximately 94% of companies worldwide currently utilize cloud software, marking a notable 14% surge since 2020.

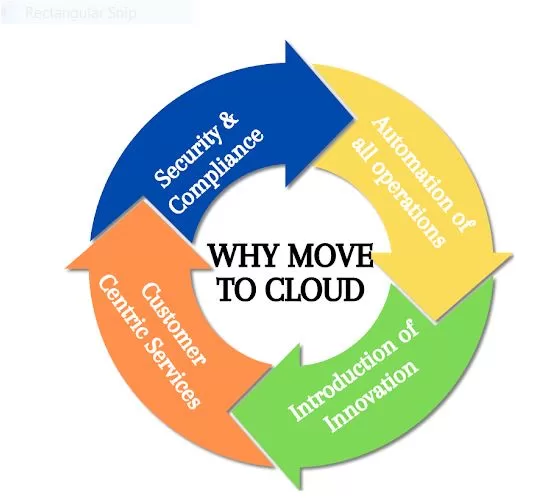

With businesses increasingly relying on cloud solutions to foster innovation and scale operations, the intricacy of navigating these deployment options has become more pronounced. Whether it’s public, private, or hybrid clouds, as well as multi-cloud and edge computing solutions, each model boasts its unique array of features, advantages, and challenges. Considerations such as data sovereignty, regulatory compliance, optimizing performance, and managing costs further add complexity to cloud deployment’s decision-making process.

As the need for agility, resilience, and operational efficiency escalates, organizations are tasked with navigating this intricate landscape with strategic understanding and proficiency. Ensuring that the chosen deployment option meets immediate requirements and aligns with long-term goals and objectives is imperative. By leveraging strategic foresight and expertise, businesses can select the most suitable deployment model that caters to their specific needs and facilitates sustained growth and innovation.

Exploring Cloud Choices

Organizations must consider various factors when deciding on cloud computing deployment models. Cloud computing has revolutionized business operations by offering flexible and scalable solutions to meet IT requirements. Let’’s explore the advantages and challenges of different cloud computing deployment models and their impacts on business growth.

Public Cloud Deployment Model

The public cloud deployment model is widely known and commonly used. It entails hosting applications and services on shared infrastructure with other organizations. The public cloud offers numerous benefits such as cost savings, scalability, and ease of use. Its pay-as-you-go pricing model helps businesses avoid upfront costs associated with building and maintaining infrastructure.

Private Cloud Deployment Model

In contrast, the private cloud deployment model is dedicated to a single organization and can be hosted on-premises or by a third-party provider. It provides enhanced security and control, making it appealing for businesses with strict compliance requirements or sensitive data.

Hybrid Cloud Deployment Model

The hybrid cloud deployment model combines elements of both public and private clouds, offering organizations flexibility and scalability. Businesses can keep sensitive data and critical applications in the private cloud while utilizing the public cloud for less sensitive workloads or demand spikes.

Community Cloud Deployment Model

Designed for specific communities or industries, multiple organizations with similar requirements share the community cloud deployment model. It facilitates collaboration and resource sharing while offering the benefits of dedicated infrastructure. While cost-effective and providing industry-specific solutions, it requires strong governance and coordination among community members.

Challenges of Navigating Cloud Models

- Public Cloud: Offers cost efficiency, scalability, and flexibility but raises data security concerns for regulated businesses.

- Private Cloud: Provides enhanced security and control but comes with high costs and overheads.

- Hybrid Cloud: Combines the benefits of public and private clouds, offering flexibility but requiring careful integration.

Impact on Business Growth

Choosing the right cloud deployment model significantly influences business growth, agility, innovation, and competitiveness:

- Scalability: Cloud models enable businesses to scale operations based on demand, promoting growth without heavy capital investments.

- Cost Efficiency: Cloud services reduce upfront costs, optimize expenses and allow resources to be allocated more effectively.

- Flexibility and Mobility: Cloud solutions empower remote work, enhance collaboration, and adapt to changing work environments, fostering innovation.

- Reliability and Security: Cloud providers ensure data protection, reliability, and disaster recovery, enhancing business continuity and competitiveness.

Best Practices for Evaluating Cloud Providers

- Assess Business Needs: Identify pain points, objectives, and requirements to align cloud models with business goals.

- Choose the Right Provider: Select reputable providers with proven expertise, reliability, and scalability to support your business needs.

- Develop a Migration Strategy: Plan a seamless transition to the cloud, prioritizing critical applications and data.

- Ensure Data Security: Implement strong security measures, encryption, and compliance to protect sensitive information.

- Establish Governance Framework: Define roles, policies, and procedures to manage cloud resources and monitor the environment effectively.

By carefully evaluating cloud deployment options, businesses can leverage cloud computing’s benefits to drive growth, innovation, and competitiveness in today’s dynamic market landscape.

Navigating Paths to Success

Understanding the available cloud deployment models is crucial for positioning your business for success. In practice, many new businesses and startups adopt the public cloud whenever possible. Existing businesses often have some on-premises infrastructure presence; transitioning to a private cloud or adopting a hybrid model is more feasible. While the private cloud may entail higher costs and overheads, it becomes necessary when data security regulations or concerns about data sovereignty are paramount. The multi-cloud approach may also be considered in finance, where high reliability is a top priority.

However, it’s important to note that each business’s choice of cloud deployment model should be tailored to its specific needs, objectives, and constraints. Factors such as cost-effectiveness, scalability, data security, regulatory compliance, and performance requirements should all be carefully evaluated before deciding. By carefully assessing cloud deployment options, businesses can leverage cloud computing’s benefits to drive growth, innovation, and competitiveness in today’s dynamic market landscape.

Contact us to learn more about the cloud deployment models that can significantly influence business growth, agility, innovation, and competitiveness.