Ever feel like the regulatory landscape is shifting beneath your feet? You’re not alone. The surge in compliance regulations is hitting lenders hard, especially the smaller players. But fear not – we’ve got your back. Handling compliance risks requires finesse, and that’s where we come in. At Insight, we don’t just understand the game;… Continue reading Regulatory Risks Hindering Operations?

Tag: regulatory compliance

Key Takeaways

- BNPL’s rapid growth draws regulatory focus on financial compliance, safeguarding consumer rights, privacy, and economic well-being.

- BNPL regulations differ by country; focus includes transparency, responsible lending, credit assessments, data privacy, and anti-money laundering.

- BNPL providers must expect upcoming regulations, engage in dialogue, enhance compliance, and adapt to diverse frameworks for successful navigation.

Growing concerns and need for regulatory compliance in BNPL space

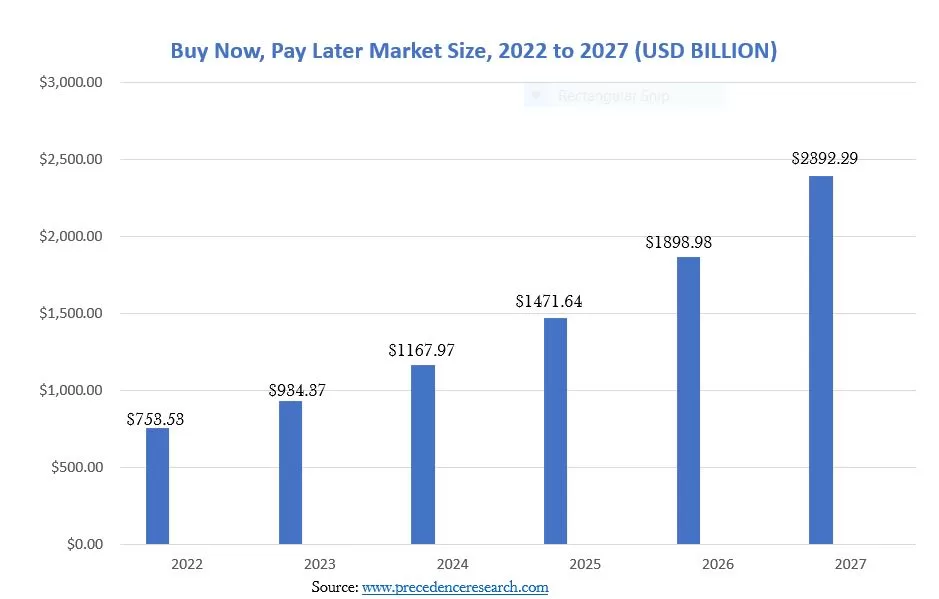

The BNPL industry has significantly expanded from 2019 to 2021. There was an astonishing 970% surge in the loans issued by BNPL lenders. Also, BNPL users quadruple.

Buy Now Pay Later (BNPL) has experienced an explosive surge in popularity thanks to its convenience, absence of interest rates, and streamlined approval process. Nevertheless, as BNPL gains traction, the importance of financial compliance within the industry has grown. With more consumers embracing this payment option, there is a pressing need to ensure adequate measures are in place to protect consumer rights, privacy, and financial well-being. As a result, regulators increasingly focus on establishing guidelines and standards to address transparency, fair lending practices, responsible lending, and anti-money laundering measures in the BNPL space. Striking the right balance between innovation and regulation is essential to foster consumer trust, maintain financial stability, and promote sustainable growth in this evolving sector. Overall, BNPL’s popularity calls for a cautious approach that prioritizes both customer convenience and protection.

Regulatory Landscape of the BNPL Industry

In virtually every country where Buy Now, Pay Later is offered as a payment method, it is commonly observed that BNPL is excluded from local laws and regulations.

As fintech businesses increasingly adopt Buy Now, Pay Later (BNPL) models, staying abreast of the latest BNPL regulatory changes and requirements becomes paramount. However, the regulatory landscape for BNPL varies across countries, with each area adopting its approach to address the unique challenges associated with these services. The Consumer Financial Protection Bureau (CFPB) has taken the lead in spearheading BNPL regulation in the United States.

Acknowledging the inherent risks associated with BNPL as a financing solution, the CFPB recently conducted a study highlighting the dangers consumers may encounter, including debt accumulation, overextension, and unauthorized harvesting of user data by BNPL providers. As a result of these findings, the specifics of forthcoming regulations are still unknown; however, industry experts anticipate the CFPB will soon unveil proposed rules. In an effort to address these concerns, anticipated regulations aim to align BNPL within the existing regulatory framework governing traditional credit companies, imposing comparable guidelines and restrictions on BNPL providers. This move comes as a means to protect consumers and ensure responsible lending practices across the industry.

Key Areas of Regulatory Scrutiny

Regulators closely examine the clarity and adequacy of disclosures provided by BNPL providers. The aim is to ensure consumers understand their financial obligations and the costs of using BNPL services.

Regulators stress responsible lending in the BNPL industry, focusing on affordability assessments and consumer protection.

Scrutinize credit assessment and underwriting in the BNPL sector, evaluating accuracy, suitability, and risk management practices.

BNPL providers are expected to comply with relevant data protection regulations, implement robust data security measures, and ensure proper consent and transparency regarding the use of customer data.

Focus on verifying customer identities, monitoring transactions for suspicious activity, and implementing measures to mitigate the risk of fraud and money laundering.

Future Ahead: Challenges to Face and Actions to Take by BNPL Providers

Until now, small, emerging fintech companies have dominated the BNPL space, managing to avoid substantial regulatory scrutiny. However, this landscape is on the brink of transformation. Despite the absence of concrete regulations thus far, which has facilitated the growth of the BNPL industry, a transitional phase is imminent. Consequently, BNPL service providers will soon face the realization of navigating a market governed by diverse regulatory regimes and varying operational approaches. In light of this upcoming shift, heightened awareness of the complexities involved in complying with regulations and adapting to different regulatory frameworks will become essential.

Major challenges

Regulators increase scrutiny

The federal financial regulatory agencies, including the CFPB, strongly focus on consumer protection. As a result, these regulatory efforts demand heightened compliance measures, stricter adherence to responsible lending practices, and robust consumer protection policies. BNPL providers must proactively invest resources and expertise to meet evolving regulatory requirements. This includes navigating complex compliance frameworks and addressing potential gaps or vulnerabilities. By doing so, BNPL companies can ensure they align with the regulatory landscape while maintaining a commitment to safeguarding consumer interests.

Increased Competition

BNPL providers struggle to differentiate in a crowded market where digital upstarts and legacy players launch new products and forge partnerships.

Banking Partners Turning Cautious

If default trends are unfavorable, they may be looking to de-risk their relationships with BNPL providers and reevaluate their role in the BNPL segment. This can result in stricter lending criteria, reduced funding opportunities, or even reconsidering their involvement in the BNPL segment altogether.

Bureau Reporting wake-up call

With major credit reporting agencies incorporating BNPL data into credit reports, the potential credit impacts of delinquent BNPL loans will become more visible to lenders and financial institutions. As a result, this heightened visibility can influence consumer behaviors, as individuals may become more cautious about their BNPL usage and repayment habits to avoid negative credit report impacts. Consequently, BNPL providers may experience a shift in customer behavior, with users adopting more responsible borrowing practices. Moreover, this increased visibility may subject BNPL providers to greater scrutiny from lenders and financial institutions with access to additional data points to assess borrowers’ creditworthiness. As a potential consequence, BNPL providers may also face the challenge of managing potentially higher default rates, prompting them to prioritize responsible lending and risk assessment strategies further.

Act now to tackle challenges

- Establish a comprehensive compliance framework aligned with regulatory requirements. This includes implementing policies, procedures, and internal controls that ensure adherence to consumer protection laws, responsible lending practices, and data privacy regulations.

- Differentiate themselves by focusing on innovative product offerings, enhancing customer experience through personalized services, and fostering strategic partnerships to expand their market reach and stand out in the crowded BNPL landscape.

- Create a regulatory strategy that allows for the growth of your risk management and compliance programs as your BNPL portfolio grows. Strengthen affordability assessments to evaluate a consumer’s loan repayment ability accurately. Consider income verification, creditworthiness checks, and other relevant factors to mitigate over-indebtedness risk.

- Prioritize responsible lending practices, implement robust credit risk assessment processes, and offer customers proactive financial education and support.

Proactive Compliance is Key for BNPL Players

While there’s no specific BNPL regulation today, there are frameworks both at the federal and state level for consumer-facing products that can be used to examine and enforce companies offering BNPL products. As a result, compliance and legal teams should be proactive and build out processes now to prepare for inevitable BNPL regulation and get out ahead of regulatory scrutiny.

Moving forward, Buy Now, Pay Later greatly appeals to merchants and consumers as a payment method. However, as the concept evolves and technology advances in the future, the BNPL industry is expected to experience continued growth. Nevertheless, the primary emphasis will now shift towards maintaining compliance with regulatory requirements and prioritizing delivering fair and transparent products that benefit consumers. In doing so, BNPL providers can position themselves for long-term success while fostering trust and confidence among their customer base. By adapting to changing regulatory landscapes and focusing on consumer well-being, the BNPL industry can thrive in an increasingly regulated financial market.

Get Insights to stay ahead in the Lending Industry.

Insights delivered monthly!

LendTech Collective

Monthly Newsletter | July 2023 (Edition:127)

In this edition:

- This edition explores current BNPL regulations, emphasizing responsible lending, consumer protection, and transparency.

- Keep abreast of the latest news in the banking & lending sector.

- Explore our coverage of cutting-edge technological developments driving the FS industry.

- Stay Updated with the Latest Events shaping the Banking & Lending Industry.

BNPL Regulation and Compliance: How to Sustain Growth.

Buy Now Pay Later (BNPL) has experienced an explosive surge in popularity due to its convenience, absence of interest rates, and streamlined approval process. The increasing adoption of BNPL has highlighted the growing significance of financial compliance within the industry. As more consumers embrace this payment option, ensuring robust measures to protect consumer rights, privacy, and financial well-being becomes imperative. Regulatory focus has intensified, with guidelines and standards addressing transparency, fair lending practices, responsible lending, and anti-money laundering measures in the BNPL space. Striking the right balance between innovation and regulation remains essential to foster consumer trust, maintain financial stability, and promote sustainable growth in this dynamic sector.

Get Insights to stay ahead in the lending industry

Insights delivered monthly!

What’s Making Headlines

UK plans to crack down on BNPL sector reportedly shelved.

Retailers and financiers for BNPL may be heaving a sigh of relief. According to reports, more stringent legislative regulation of the buy-now-pay-later industry may be postponed.

Union Credit Launches Marketplace of Trusted Credit Union Lenders.

Union Credit launched the first marketplace for credit unions to make firm, one-click credit offers at the point of purchase. Union Credit is the pioneer marketplace for credit unions to reach new, credit-worthy members from outside their ecosystem,

Fed set to launch long-awaited instant payment service

The U.S. Federal Reserve is due to imminently launch a long-awaited service which will aim to modernize the country’s payment system by eventually allowing everyday Americans to send and receive funds in seconds, 24 hours a day, seven days a week.

Tech Talk

Google’s generative AI news writing tool undergoes testing, suggests report.

Google is reportedly developing an AI tool called Genesis to help journalists write news articles. The tool uses a large language model and aims to address challenges associated with generative AI.

The US government has launched the Cyber Trust Mark, an IoT security labeling program.

The Biden administration has launched its long-awaited Internet of Things (IoT) cybersecurity labeling program that aims to protect Americans against the myriad security risks associated with internet-connected devices.

Plaid Beacon introducing real-time fraud prevention solution

Plaid has announced the launch of Plaid Beacon. This anti-fraud network enables real-time, secure data sharing across the ecosystem to mitigate repeat fraud against businesses for fintech and banks via API (Application Programming Interface).

Fintech Buzz

For any feedback, suggestions, or questions, feel free to write to us at: editors@insightconsultants.online.

In the ever-evolving landscape of the lending industry, compliance has emerged as a vital cornerstone for success. With its complex regulatory framework and stringent requirements, the financial services sector emphasizes maintaining compliance standards. For lenders, adherence to regulatory guidelines and industry best practices is not merely a legal obligation but a strategic imperative. It ensures the integrity of their operations, builds trust with customers and stakeholders, and safeguards against reputational risks and costly penalties.

In this article, we delve into the top compliance challenges facing the financial services industry, shedding light on the importance of compliance and its profound impact on the lending landscape.

Top 5 Compliance Challenges

The financial services industry faces the daunting task of constantly changing regulations, such as new data privacy laws, environmental regulations, and anti-money laundering measures. Financial institutions, including smaller ones, must allocate resources to ensure compliance, often straining their budgets.

Managing cybersecurity risks in the financial industry is challenging due to the increasing sophistication of cyber threats and the evolving regulatory landscape. Financial organizations must invest in robust cybersecurity measures, which can be resource intensive. Additionally, staying updated with compliance requirements and adapting security measures accordingly is crucial. Fostering a culture of security awareness among employees further adds complexity to maintaining effective cybersecurity practices.

The cost of neglecting cybersecuirty risks include

- Financial losses from data breaches and theft

- Reputational damage and loss of customer trust

- Legal and regulatory consequences for non-compliance

- Operational disruptions and downtime

- Intellectual property theft and compromise

- Negative impact on employee morale

- Customer loss and decreased loyalty

Organizations must prioritize cybersecurity and implement robust measures to protect their data, systems, and reputation to avoid these costs.

The growing emphasis on data privacy, fueled by regulations like the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), necessitates stringent data governance practices and mechanisms to safeguard customer information. Ensuring overall privacy and data security can be challenging as cyber threats evolve and become more sophisticated.

Measures to Protect Data Privacy and Compliance

- Implement strong data security measures such as encryption, firewalls, and access controls.

- Develop and enforce clear data privacy policies and regularly train employees on their responsibilities.

- Conduct regular data privacy assessments to identify and address vulnerabilities.

- Obtain explicit consent and provide transparency on how personal data is used.

- Keep security systems and software up to date to address vulnerabilities.

- Train employees on data privacy best practices and promote a culture of privacy awareness.

- Establish an incident response and data breach notification procedures.

- Choose trusted service providers with strong data privacy practices.

Environmental, Social, and Governance (ESG) considerations are gaining prominence, requiring financial institutions to integrate sustainability principles into their operations, disclosures, and risk management frameworks to meet evolving ESG compliance requirements. Financial institutions must also consider social factors such as diversity, inclusion, and community impact in decision-making. Additionally, effective governance practices entail transparent reporting, ethical conduct, and risk management aligned with ESG standards. Meeting evolving ESG compliance requirements involves developing policies, frameworks, and reporting mechanisms to ensure alignment with sustainability goals and meet the expectations of regulators, investors, and stakeholders.

Indeed, the need for more talent in the compliance sector is a significant challenge. The demand for skilled compliance professionals has been increasing due to the growing complexity of regulations and the need for organizations to ensure compliance. However, finding and retaining qualified individuals with the necessary expertise in compliance and regulatory matters can take time and effort. This talent shortage creates a competitive landscape for organizations seeking to fill compliance roles and poses a risk in maintaining effective compliance programs. Organizations must invest in talent development, recruitment strategies, and training initiatives to address this challenge and build a capable compliance workforce.

Steps to alleviate compliance challenges

- Embrace Technology for Agile Compliance: Embrace advanced software solutions that automate compliance processes, enabling your organization to stay updated with evolving regulations. Implement real-time monitoring, data analytics, and machine learning algorithms to identify and adapt to regulatory changes promptly.

- Enhance Risk and Compliance Measures: Utilize technology-powered risk assessment and management tools to identify, assess, and prioritize risks across your organization. Leverage data analytics, machine learning, and artificial intelligence to analyze data and gain valuable insights for effective risk mitigation strategies.

- Implement Robust Compliance Monitoring: Establish robust monitoring mechanisms to identify and address compliance issues proactively. Leverage technology to automate monitoring processes, ensuring timely detection of any compliance deviations. Maintain accurate records and generate comprehensive reports to demonstrate compliance with regulatory authorities.

- Conduct Regular Compliance Reviews: Schedule periodic reviews and assessments of your compliance program to identify gaps or areas requiring enhancement. Utilize technology to streamline review processes, track progress, and implement necessary adjustments to strengthen compliance measures.

Ensuring compliance for sustainable success

Compliance has become a critical aspect of success in the lending industry. Financial institutions must navigate a complex regulatory landscape to maintain integrity and protect their customers and stakeholders. By embracing technology, enhancing risk and compliance measures, implementing robust monitoring, and conducting regular reviews, lenders can strengthen their compliance efforts and stay ahead of evolving regulations.

Contact Us if you want to learn more about how our technology services can help your compliance management.

Get Insights to stay ahead in the Lending Industry.

Insights delivered monthly!

LendTech Collective

Monthly Newsletter | July 2023 (Edition:126)

In this edition:

- In this edition, we delve into the importance of Unlocking Seamless Onboarding and Tackling Compliance Hurdles.

- Stay up-to-date with the latest news in the banking & lending sector.

- Explore our coverage of the latest technological developments driving the FS industry.

Featured Article: Digital Onboarding Solutions for a Frictionless Customer Journey

The adoption of digital onboarding represents a paradigm shift in the lending industry. Lenders leveraging technological advancements can streamline onboarding, enhance customer satisfaction, and drive operational efficiency. By embracing digital onboarding, lenders can demonstrate their commitment to providing a modern and customer-centric experience, setting themselves apart from competitors. Lenders have a range of digital onboarding solutions to streamline the customer onboarding process.

Must Read: Unveiling the Top 5 Compliance Challenges for the Financial Services Industry

In the ever-evolving landscape of the lending industry, compliance has emerged as a vital cornerstone for success. With its complex regulatory framework and stringent requirements, the financial services sector emphasizes maintaining compliance standards. In this article, we delve into the top compliance challenges facing the financial services industry, shedding light on the importance of compliance and its profound impact on the lending landscape.

Get Insights to stay ahead in the lending industry

Insights delivered monthly!

What’s Making Headlines

Japanese financial powerhouses pursue US investment banking opportunities

Executives say that Japan’s top lenders aim to carve out a larger presence in U.S. investment banking as they look to better use their massive balance sheets by winning a bigger slice of deals.

Recession fears overshadow Credit Unions’ strength in auto loans

The concerns about a recession negatively impact the perception of credit unions’ strength in the auto loan market. Despite credit unions historically being a reliable and competitive source for auto financing, the fear of an economic downturn has led to increased caution among borrowers.

Biden proposes new student-loan measures after court defeat

Following a court defeat, President Biden has put forward new proposals aimed at addressing the challenges surrounding the student loan. The new proposal may include options such as expanded loan forgiveness programs, income-driven repayment plans, and enhanced borrower protections

Tech Talk

EU and Japan seek collaboration on AI and chips amid China’s ‘de-risking’ efforts

The EU is looking to “de-risk” from China, and part of that strategy involves deepening the relationship with allied countries around technology.

Avaloq chosen by Capital Union Bank for new online banking platform

Capital Union Bank, based in the Bahamas, has chosen Avaloq’s Web Banking solution as the driving force behind its upcoming online banking platform. The bank is also planning to enhance its core banking system through collaborative innovation with Avaloq, incorporating new modules and features.

Plaid Beacon introducing real-time fraud prevention solution

Plaid has announced the launch of Plaid Beacon. This anti-fraud network enables real-time, secure data sharing across the ecosystem to mitigate repeat fraud against businesses for fintech and banks via API (Application Programming Interface).

For any feedback, suggestions, or questions, feel free to write to us at: editors@insightconsultants.online.

Regulatory Compliance for Fueling Business Growth.

LendTech Collective Monthly Newsletter-June 2023. Edition- 125 Navigating Regulatory Compliance: How Lenders Can Leverage. Regulatory compliance is a big deal in the lending business. It’s not something you can afford to ignore or take lightly. Following the rules and regulations set by the authorities is crucial for lending institutions to stay out of trouble and… Continue reading Regulatory Compliance for Fueling Business Growth.

Regulatory compliance is a big deal in the lending business. It’s not something you can afford to ignore or take lightly. Following the rules and regulations set by the authorities is crucial for lending institutions to stay out of trouble and keep their operations running smoothly. Operating in a non-compliant manner can face hefty fines, legal concerns, and damage to your reputation that might be hard to recover from.

In recent years, financial institutions have faced billions of dollars in fines due to non-compliance with lending regulations. Yep, you heard it right—billions! That’s a staggering amount that could seriously dent your bottom line and put your business in jeopardy. It’s not just about playing by the rules; it’s about protecting your business and setting yourself up for long-term success.

Lenders battle compliance complexity

Lenders face significant challenges in the compliance landscape due to the complex and evolving regulatory environment. Firstly, the sheer volume and complexity of regulations can be overwhelming for lenders to navigate. They must keep up with many rules and requirements, often varying across jurisdictions, increasing compliance efforts’ complexity. Additionally, regulatory agencies frequently introduce new regulations or update existing ones, making it challenging for lenders to stay current and ensure compliance. Lenders must also invest in robust compliance systems and technologies to monitor and track compliance activities effectively. Moreover, the risk of non-compliance penalties, fines, and reputational damage adds to lenders’ pressure.

The potential costs of non-compliance are staggering and extend far beyond simple fines. Organizations lose an average of $5.87 Million in revenue due to a single non-compliance event.

Here are some recent and shocking data points to consider:

- In 2020 alone, banks were fined $14.2 Billion for non-compliance, with the United States accounting for 78% of issued fines.

- JP Morgan was fined $125 million in 2021 for failing to implement compliance controls.

Compliance efforts often require dedicated teams, resources, and ongoing training to ensure adherence to regulations. Overall, lenders must continually adapt to the changing compliance landscape, stay ahead of regulatory changes, and invest in compliance infrastructure to mitigate risks and maintain regulatory compliance.

Lenders non-compliance fallout

Unveiling the aftermath of non-compliance, lenders face the daunting fallout that reverberates through their operations and reputation.

- Financial penalties and fines imposed by regulatory authorities for non-compliance

- Potential suspension or revocation of the firm’s license to operate.

- Strained relationships with loan providers due to loss of trust and hesitancy to provide further funding.

- Limited access to financing and credit facilities hinders the firm’s growth plans.

- Adverse publicity and damage to the firm’s reputation

- Erosion of customer trust and confidence, leading to a loss of clients and business

- Rebuilding a tarnished reputation requires significant resources and time.

Mitigating Regulatory Compliance Risks: Essential Steps for Operational Resilience

In the dynamic landscape of complex regulations, gaining a profound comprehension of compliance risks is paramount. By stepping back and assessing vulnerabilities within your loan cycle you can effectively mitigate these risks and navigate the complexities of the regulatory environment.

Let us dive in and conquer regulatory compliance together!

- Robust Compliance Framework: Establish a comprehensive compliance framework that includes policies, procedures, and controls to ensure adherence to regulatory requirements.

- Regular Risk Assessments: Conduct regular risk assessments to identify and mitigate compliance risks specific to your organization. Stay updated on industry trends and regulatory changes that may impact your operations.

- Technology Adoption: Invest in compliance-focused technology solutions such as automated monitoring systems, data analytics tools, and risk management software to enhance efficiency and accuracy in compliance processes.

- Compliance Monitoring and Reporting: Implement robust monitoring mechanisms to identify and address compliance issues proactively. Maintain accurate records and generate timely reports to demonstrate compliance with regulatory authorities.

- Regular Compliance Reviews: Conduct periodic reviews and assessments of your compliance program to identify gaps or areas that need enhancement and implement necessary adjustments.

How can Insight Consultants help?

Building an effective compliance strategy is crucial and can be a big lift for firms. At Insight, we are flexible in supporting your compliance responsibilities.

We offer:

- Automate and customize adverse action notices, ensuring adherence to regulatory requirements while streamlining the process and improving consumer communication efficiency.

- Generate personalized notices tailored to individual consumers, reducing errors and enhancing communication effectiveness.

- Support multiple versions of customizable notices, accommodating diverse variations and specific requirements, providing the necessary flexibility in the notification process.

- Automated email, text, and on-screen notifications to ensure the generation of disclosures within the specified time frame, promoting timely delivery and compliance.

- Additional automated email, text, and on-screen notifications to ensure that applications are decisioned following your institution’s service levels.

- We have established systems and procedures to effectively handle data collection, testing, and compliance requirements associated with regulations such as HMDA, CIP, MLA, HPML, HCML, ATR, and QM.

- Text /email alert system to notify users of any changes in loan status, including loan declines, withdrawals, or other updates.

With the ever-changing regulatory landscape, lending firms are presented with a prime opportunity to use technology to proactively reshape their compliance function. By strategically modifying their operating model and processes, they can elevate the quality of oversight and drive operational efficiency. Embracing this transformative journey equips lending firms with a competitive edge, allowing them to deliver exceptional service, optimize costs, and effectively manage operational risks.

If you want to learn more about our compliance management services, contact us here.

Get Insights to stay ahead in the Lending Industry.

Insights delivered monthly!