Loan processing is often a complicated and time-consuming process. It works with multiple partners and business providers. Before its completion, on an average, it will take 20-30 days to close a loan. But today’s customer expects fast, seamless and hassle-free access to loan services at a time, place and channel of their choice. They seek… Continue reading How Automation can help lenders achieve faster loan processing time?

Category: Technology

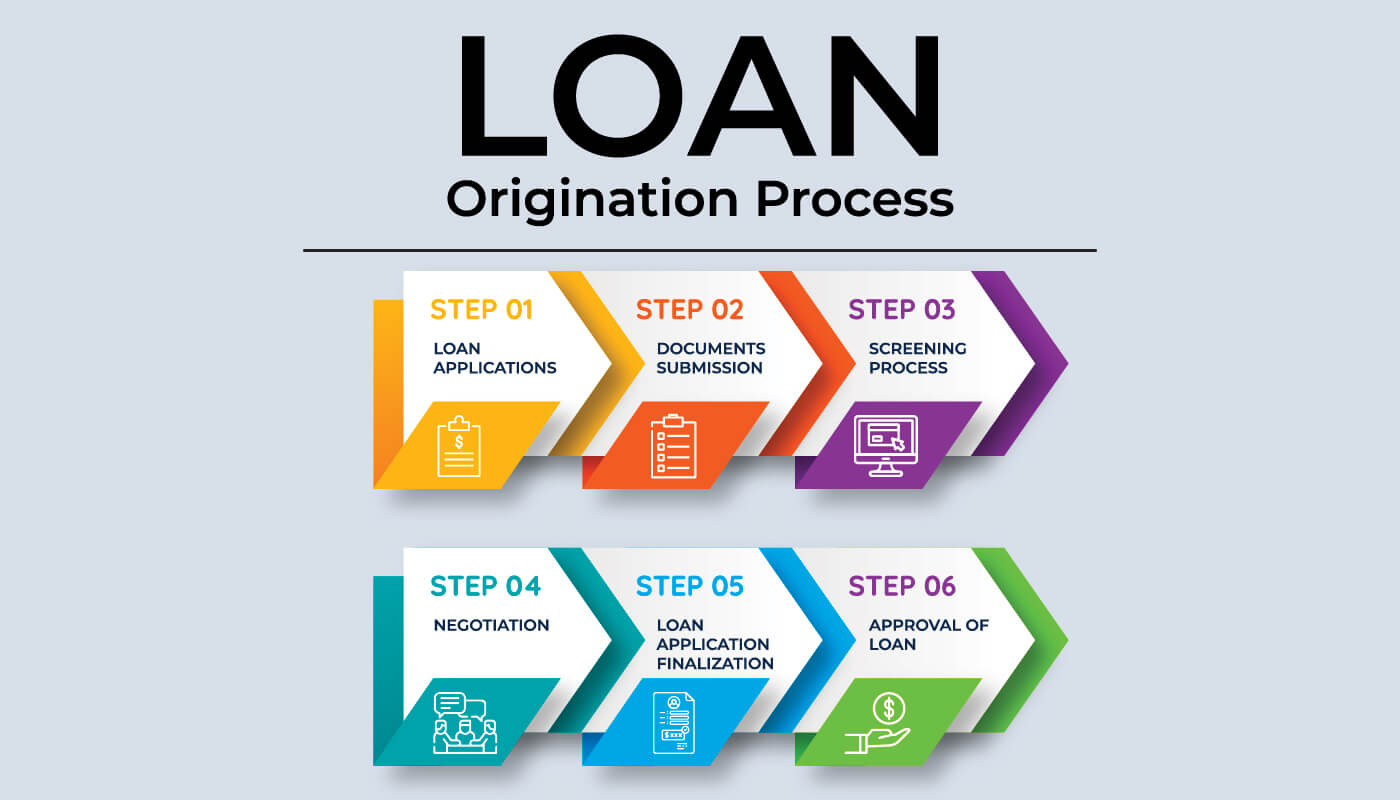

How software addresses the challenges in loan origination

In the dynamic landscape of lending, staying competitive necessitates a tailored loan processing solution that seamlessly evolves with your business. However, both lenders and borrowers encounter various challenges throughout the loan closing journey. Let’s explore major origination challenges and how software solutions can effectively tackle them: Complexity in Documentation: The loan origination process often… Continue reading How software addresses the challenges in loan origination

How digital lending can be a game changer in SME financing?

Financing is the backbone of any business, but this is an area which is extremely difficult for most SMEs, small businesses and start-ups to navigate through. One of the main hurdles was the lack of ease in transactions faced by SMEs. But with digital lending, SMEs were able to solve many of the financing problems… Continue reading How digital lending can be a game changer in SME financing?

Role of Artificial Intelligence in cyber security

As digital lending continues to grow, firms are looking for ways to secure their delicate data. Here Artificial Intelligence has become the need of the hour. AI’s crucial role right now is to offload work from human cybersecurity engineers, to handle the depth and detail that humans cannot tackle fast enough or accurately enough. Advances… Continue reading Role of Artificial Intelligence in cyber security

Why alternative lending solutions best for your SME lending?

SME sector is fast growing, and it has become an important part in the growth of economies. Despite all these if your small business is looking for funding, there are several roadblocks in front of you. Most SMEs struggle to acquire enough credit to keep their company afloat and operational. Most of the cases it… Continue reading Why alternative lending solutions best for your SME lending?

Top 5 steps in selecting your lending technology

Today’s customers expect fast and seamless operations and therefore lending firms are looking for ways to make their services more efficient and profitable to both lenders and borrowers. Technology is the tool lenders rely on most to gain competitive advantages over their rivals. Identify and embrace the right technology is most essential for the lenders… Continue reading Top 5 steps in selecting your lending technology

Predictive Analytics for efficient risk management for lenders

The consumer lending business is centered on the notion of managing the risk of borrower default. To effectively manage the loan life cycle, and specifically address the complexities of risk management throughout the loan life cycle, financial institutions must rely on the use of technologies that inherently improve business results through more efficient workflows, better… Continue reading Predictive Analytics for efficient risk management for lenders

A solution for retail banking – Loan origination software

The business of loans has undergone significant change owing to the financial crisis and emergence of non-banking entities paving way for people’s money reaching borrowers at a much lower cost and with lesser hassles. Advancing technology and changing customer preferences are driving significant changes in Banking interactions. Banks need to continuously adapt and increasingly adopt… Continue reading A solution for retail banking – Loan origination software

Must check points while selecting your Loan Origination Solution

Today’s customers have no patience for the mounds of paperwork and lengthy processes, redundant requests or lack of process transparency when applying for loans. Many banks still struggle with manual processes, duplication of data entry and data entry errors when processing loan applications. So, selecting Loan origination solution for your servicing business can be a… Continue reading Must check points while selecting your Loan Origination Solution

How P2P Lending could benefit from block chain?

Block chain is a trending technology that is revolutionizing global financial sector. Its impact on various industries has been so positive that even the lending market has taken note. P2P Lending firms globally have started harnessing blockchain concepts as it is a potentially disruptive technology. Start-ups in this space are all set to invest in… Continue reading How P2P Lending could benefit from block chain?