Open banking has emerged as a transformative force in the financial industry, revolutionizing how lending institutions

Tag: open banking

The pandemic has halted the proliferation of traditional paper-driven, face-to-face loans and forced commercial lenders to move toward digitalization. Additionally, fintech companies addressing the same issues are on the rise and are giving traditional consumer lenders a run for their money. Consumers are now moving towards creating bank accounts online to conduct transactions digitally. Meanwhile, an appetite for “Open Banking” is picking up pace worldwide.

Why Should Business Lending Use Open Banking?

Lenders require account data to make decisions on which businesses are eligible for loans. Open Banking is driven by regulatory, technology, and competitive dynamics. It calls for banks to use APIs to make certain customer data available to non-bank third parties. The innovation is evolving the industry toward hyper-relevant, platform-based distribution and giving banks a rich opportunity to expand their ecosystems and extend their reach.

Cloud-based APIs are at the heart of these digital transformation strategies. Simple plug-and-play functionality makes it possible for financial institutions to adopt an integrated environment of applications, all designed to automate critical workflows to return faster credit decisions. Aggregating data across multiple accounts into one easy-to-use platform, offers customers a 360-degree view of their spending and simplifies the ever-growing number of touchpoints they encounter daily. Open banking will also enhance real-time payments, going head-to-head with the card scheme to enable instant transactions between retailers and consumers.

Open banking allows for automated bank statement collection. It also provides data on the debt and cash flow profile of a business that enables business lenders to understand the financial health of a business.

The Future

From offering personalized insights to simplifying payment transactions, Open Banking provides the spark banks need to develop modern financial tools that provide even more value to their customers. It’s like a collaboration between traditional bank players and new financial players. Moreover, open banking is helpful for SMEs as well. Via APIs, fintech companies will be able to access different types of accounts, insurance, card accounts, and leases, and consolidate data from multiple countries into one frame.

As we enter this next phase of the recovery, the future is unfolding. 2021 has taught all of us a lot about handling the unexpected. Although FinTechs have been upending traditional banking models for years, the pandemic presented opportunities to enterprises to reinvent, adapt and emerge stronger. To ensure the continuation of the economy, lenders were responsive by creating new business models, targeting new customer segments, and future-proofing new strategies.

As we stepped into 2022, let’s find out the Lending trends for this year and how can lenders adapt to them.

Trends that will shape lending in 2022

Customer Affordability as a Service: As economic activity rebounds, people are facing elevated levels of inflation with potential increases in interest rates forecast in early 2022. To meet the increasing regulatory requirements and to ensure good customer outcomes, firms need to work towards more customer-centric affordability assessments. The introduction of consistent modelling for income and outgoings across all areas of the business will give lenders increased control, consistency, and agility to react to regulatory changes.

Open Banking battle heats up: From frictionless payments to providing more secure and simple ways to pay – open banking will be a headline trend in 2022. The growth of Open banking represents both a challenge and an opportunity to the traditional incumbents in the payments and lending markets, who will need to have and execute a clearly defined Open Banking strategy.

‘Buy-now pay- later’, is trending : The global pandemic and the growing need for splitting the cost of purchases over a period has led to widespread adoption of BNPL products. According to the Q4 2021 BNPL Survey, BNPL payment in the United States is expected to grow by 66.5% on annual basis to reach US$ 82086.8 million by the end of 2022.

Demand for alternative credit scoring: With the novel coronavirus pandemic disrupting economies around the world, the importance of credit as a tool for rebuilding has come into sharp relief — as has the need for alternative scoring for borrowers. Traditional systems restrict borrowers with no credit history, alternative credit scoring software solutions open an opportunity for such applicants by analyzing and giving a gauge of the overall financial health of applicants with no credit score.

Automation will expand among mainstream lenders: Automation will continue its rapid expansion in 2022 from its current position. According to predictions by Gartner, the worldwide market for technology that enables hyper-automation is set to reach $596.6 billion in 2022, up from $481.6 billion in 2020.

Final thoughts

Thanks to the pandemic and technological advances, major shifts are coming for finance. Customers’ financial needs are constantly evolving. It’s time for financial leaders to think beyond traditional bottom-line metrics and develop strategies that serve both business and societal needs by putting purpose and trust at the top of the agenda. There’s never been a better time to reach higher.

The LendTech Collective

Insights to stay ahead!

Bimonthly Newsletter | Mar 2022 | Issue 117

Featuring

- Lending Trends 2022 – how can Lenders adapt to become successful?

- How does Open Banking help Lenders in simplifying the processes?

- In the News

- Major Events

Focus On

Lending Trends 2022 – how can Lenders adapt to become successful?

As we enter this next phase of the recovery, the future is unfolding. 2021 has taught all of us a lot about handling the unexpected. Although FinTechs have been upending traditional banking models for years, the pandemic presented opportunities to enterprises to reinvent, adapt and emerge stronger. To ensure the continuation of the economy, lenders were responsive by creating new business models, targeting new customer segments, and future-proofing new strategies.

As we stepped into 2022, let’s find out the Lending trends for this year and how can lenders adapt to them.

Trends that will shape lending in 2022

Customer Affordability as a Service: As economic activity rebounds, people are facing elevated levels of inflation with potential increases in interest rates forecast in early 2022. To meet the increasing regulatory requirements and to ensure good customer outcomes, firms need to work towards more customer-centric affordability assessments. The introduction of consistent modelling for income and outgoings across all areas of the business will give lenders increased control, consistency, and agility to react to regulatory changes.

Open Banking battle heats up: From frictionless payments to providing more secure and simple ways to pay – open banking will be a headline trend in 2022. The growth of Open banking represents both a challenge and an opportunity to the traditional incumbents in the payments and lending markets, who will need to have and execute a clearly defined Open Banking strategy.

‘Buy-now pay- later’, is trending : The global pandemic and the growing need for splitting the cost of purchases over a period has led to widespread adoption of BNPL products. According to the Q4 2021 BNPL Survey, BNPL payment in the United States is expected to grow by 66.5% on annual basis to reach US$ 82086.8 million by the end of 2022.

Demand for alternative credit scoring: With the novel coronavirus pandemic disrupting economies around the world, the importance of credit as a tool for rebuilding has come into sharp relief — as has the need for alternative scoring for borrowers. Traditional systems restrict borrowers with no credit history, alternative credit scoring software solutions open an opportunity for such applicants by analyzing and giving a gauge of the overall financial health of applicants with no credit score.

Automation will expand among mainstream lenders: Automation will continue its rapid expansion in 2022 from its current position. According to predictions by Gartner, the worldwide market for technology that enables hyper-automation is set to reach $596.6 billion in 2022, up from $481.6 billion in 2020.

Final thoughts

Thanks to the pandemic and technological advances, major shifts are coming for finance. Customers’ financial needs are constantly evolving. It’s time for financial leaders to think beyond traditional bottom-line metrics and develop strategies that serve both business and societal needs by putting purpose and trust at the top of the agenda. There’s never been a better time to reach higher.

Keep Reading

How does Open Banking help lenders in simplifying the processes?

The pandemic has halted the proliferation of traditional paper-driven, face-to-face loans and forced commercial lenders to move toward digitalization. Not only this – fintech companies addressing the same issues are on the rise and are giving traditional consumer lenders a run for their money. Manual processes associated with reviewing, servicing, tracking, and maintaining commercial loan transactions have become automated. Technological advancements have allowed for more reliable and simpler application processes.

Here appetite for “Open Banking”, pace picking up worldwide. Consumers allow third-party providers to use the financial information held by their bank to make decisions on which businesses are eligible for loans.

Why does business lending use Open Banking?

Lenders require account data to make decisions on which businesses are eligible for loans. Open Banking—driven by regulatory, technology, and competitive dynamics—calls for banks to use APIs to make certain customer data available to non-bank third parties. The innovation is both evolving the industry toward hyper-relevant, platform-based distribution and giving banks a rich opportunity to expand their ecosystems and extend their reach.

Cloud-based APIs are at the heart of fast and efficient digital transformation strategies. Simple plug-and-play functionality makes it possible for financial institutions to adopt an integrated environment of applications, all designed to automate critical workflows to return faster credit decisions. The method of aggregating data across multiple accounts into one, easy-to-use platform, offering customers a 360-degree view of their spending and simplifying the ever-growing number of financial touchpoints customers encounter daily. Open banking will also enhance real-time payments, going head-to-head with the card scheme to enable instant transactions between retailers and consumers.

Open banking allows for automated bank statement collection. It also provides data on the debt and cash flow profile of a business that enables business lenders to understand the financial health of a business.

The potential benefits of Open Banking

1. Improved customer experience

2. New revenue streams

3. Sustainable service model for traditionally underserved markets.

Future

From offering personalized insights to simplifying payment transactions, Open Banking provides the spark banks need to develop modern financial tools that provide even more value to their customers. It’s like a collaboration between traditional bank players and new financial players. Moreover, open banking is helpful for SMEs as well. Via APIs, fintech companies will be able to access different types of accounts, insurance, card accounts, and leases, and consolidate data from multiple countries into one frame.

Get insights to stay ahead in lending industry

Insights delivered monthly !

In the News

First Community Bank and Trust selects Lendsmart to digitize its lending

First Community Bank and Trust, a privately owned bank serving individuals, families, and businesses in Beecher and Peotone, IL, and across the state, has selected Lendsmart, an AI-driven digital lending platform, to enhance its digital lending operations.

With Lendsmart’s technology, First Community Bank and Trust will own the entire customer journey end to end, helping its borrowers every step of the way. From quickly processing a loan application to assisting with the ancillary services a customer needs, borrowers, will be able to move into their new homes in record time. First Community Bank and Trust will offer a more streamlined experience.

Lendsmart’s capabilities align with First Community Bank and Trust’s commitment to providing banking products and services, including mortgage, consumer, and commercial lending.

“We know that banking needs to be as convenient as possible today,” said Greg Ohlendorf, President, and CEO of First Community Bank and Trust. “That’s why we’re dedicated to offering not only the latest in technology but also outstanding customer service. Lendsmart will allow us to make the home buying and lending experience easier for our customers.”

Working with Lendsmart will enable First Community Bank and Trust to offer a more efficient process with one end-to-end platform that uses artificial intelligence to automate and digitize up to 70% of the lending and home buying processes – improving accuracy, minimizing risk, and reducing origination and operational costs.

“We’re honored to be partnering with First Community Bank and Trust and looking forward to helping the bank offer a seamless customer experience and process more loans,” said AK Patel, Founder, and CEO of Lendsmart. “At the same time, the bank’s reputation will also provide us with an opportunity to expand our reach in the industry.”

Worldwide Foundation lanunches fund for Ukraine CUs

The Worldwide Foundation for Credit Unions (WFCU) announced, it created the Ukrainian Credit Union Displacement Fund to help mitigate impacts to the Ukrainian credit union system as Russian troops continue their violent offensive against the country.

Within the first few hours, WFCU officials said it had already raised $43,000.

During the Cooperative Voices Event in Washington, D.C., WOCCU President/CEO Elissa McCarter LaBorde said, “Thank you to the [Worldwide] Foundation staff. This is the right thing to do, this is the global community, this is the power of a network like this.”

According to a statement from WOCCU, it has a pair of member credit union associations in Ukraine with a 30-year history of providing both regulatory and development support to build and strengthen credit unions there.

WFCU is the charitable and engagement arm of WOCCU.

Bluefox acquires Crossraod Lending, launches Digital Finance Club

LA-based sales company and distributor Blue Fox Entertainment has acquired Crossroad Lending and formed digital financing hub Blue Fox Financing.

Patrick Rizzotti developed and created Crossroad Lending services to connect filmmakers with a database of film and television lenders and equity financiers and was designed with producers in need of cash flow for films gearing up for production and financial institutions and individual investors in need of low-risk lending sources.

Blue Fox Financing will focus on US tax credit loans, gap/super gap loans, US minimum guarantees, and/or foreign pre-sales and estimates.

Huntsman, who launched Blue Fox Entertainment in 2015, said while Blue Fox Financing was “a natural extension” of his company’s sales and distribution business it would be run as a stand-alone company overseen by Rizzotti.

Fintech startup Lendai raises $35M for AI-based underwriting system

FinTech startup Lendai has raised $35 million in equity and debt seed funding, ZDNet reported.

This additional funding will let the company let foreign, non-residential borrowers investing in U.S. real estate properties access immediate funding and competitive rates using its artificial intelligence (AI)-based Triple Digital Underwriting System, which aims to make the underwriting process more efficient.

Additionally, it will help Lendai expand its services to more U.S. states and launch new loan programs.

According to CEO and co-founder Yair Benyamini, the Lendai network encompasses a swathe of almost 200 partners, including real estate agents, property management companies, loan brokers, marketplaces, developers, lawyers, accountants, and more. Speaking with ZDNet, Benyamini said the network is scattered around the world.

“We basically sit on all the entry points into the market, and this allows us to write to thousands of clients that are in these countries, with minimal effort,” he said.

The funding round was led by Meron Capital and Cardumen Capital, Discount Capital, Skywell Capital Partners, Mindset Ventures and Viola Credit offered underwriting help.

Businesses in need of payments, accounts, and cards are seeing a new surge in FinTechs helping them out.

Events

Canadian Fintech Summit

5-6, Apr 2022, 101, College Street, Lower Concourse Auditorium, Ontario, Canada.

Insight Consultants are focused on making level the rough roads that exist in the lending industry. We serve customers globally from our offices in the US and India.

As financial institutions shift toward a digital end-to-end lending process, they are setting the groundwork for a new era in banking founded on Fintech partnerships and an open ecosystem.

Rise of open banking

Open Banking—driven by regulatory, technology and competitive dynamics—calls for banks to use APIs to make certain customer data available to non-bank third parties. The innovation is both evolving the industry toward hyper-relevant, platform-based distribution and giving banks a rich opportunity to expand their ecosystems and extend their reach.

Open Banking has become a global movement driven by regulatory, customer and ecosystem forces, each shaping the outcomes of a bank’s Open Banking initiatives. In order to deliver these outcomes, realize the full value from Open Banking, as well as keep improving their offerings, banks need to measure and monitor not only the key performance indicators (KPIs) specific to Open Banking, but also the impact of these KPIs on the performance of the business at a higher level.

The potential benefits of open banking are substantial: improved customer experience, new revenue streams, and a sustainable service model for traditionally underserved markets.

So, Open Banking in simplifying payments-how it helps?

Open Banking in Simplifying Payments

Open Banking grants access to financial data to third-party developers (provided users give their permission). By enabling non-financials to develop APIs around existing banking infrastructure, a host of innovative new services and applications are now improving the customer experience.

Cloud-based APIs are at the heart of fast and efficient digital transformation strategies. Simple plug and play functionality make it possible for financial institutions to adopt an integrated environment of applications, all designed to automate critical workflows to return faster credit decisions. The method of aggregating data across multiple accounts into one, easy-to-use platform, offering customers a 360-degree view of their spending and simplifying the ever-growing number of financial touchpoints customers encounter daily. Open banking will also enhance real-time payments, going head-to-head with the card scheme to enable instant transactions between retailers and consumers.

Sharing of limited data on “thin file” consumers can help to advance financial inclusion goals, pooling limited information to arrive at more precise risk-scoring and credit-underwriting decisions. By introducing more consumers to the formal financial system, open banking increases the market opportunity and the potential to deliver profitable services in the future.

Conclusion

From offering personalized insights to simplifying payment transactions, open banking provides the spark banks need to develop modern financial tools that provide even more value to their customers. As the payments landscape grows increasingly competitive, American banks that embrace APIs will appeal to prospective customers with innovative services while strengthening loyalty among their existing clientele.

Monthly Newsletter | Mar 2021 | Issue 111

Featuring

How Lenders can adapt to the changing trends in commercial lending in 2021

Simplifying payments with Open Banking

Tech Bites

In the News

Major Events

Key Stats

Focus On

How Lenders can adapt to the changing trends in commercial Lending 2021

2020 has been a year of uncertainty for every business. For financial institutions, marketers, and everyday consumers, 2020 has presented challenges that are simply unprecedented. As we entered 2021, in the post pandemic world, lending has changed and evolved. Lenders are looking at an era of unprecedented uncertainty in lending, as potential write-offs loom and the effects of a low-interest rate environment inhibit profitability.

Here is the list of major Lending trends for 2021 and let’s find out how lenders can adapt to those changes.

Lending Outlook 2021: the road ahead

1)Drop in Refinancing

2)Slow Recovery Rate

3)Drop in Qualified Borrowers

4)Auto Financing will be stronger

5)Fintech Lenders will attract more loans

Let’s see the trends in detail:

Drop in Refinancing: Refinancing are projected to drop by 46%. Low mortgage rates will drive a shift towards refinancing.

Slow Recovery Rate: Pandemic has created a destructive economy with business shuts and job losses. This scenario led to a slower recovery rate in consumer lending business.

Drop in qualified borrowers: Qualified borrowers could be hard to come. Given the current state of the economy, while demand for consumer loans should stay high, the quality of eligible consumer loans might not.

Stronger Auto Financing Sector: Auto loans remain a source of high-quality loans. Sales of new cars rebounded somewhat in 2020 and that rebound will continue to influence the sales picture over the next few years.

Strong Fintech Sector: Fintech lenders will attract more—and better—loans. Not only are fintech lenders increasing their market share, but they are also moving up credit tiers and going mainstream. As consumers go online first to find the best offers, marketplace lending is gaining in popularity and fintech lenders are consuming more of the loans that credit unions want and need.

So, How Lenders can stay ahead of these trends? .

Areas lenders need to focus on 2021 to stay ahead

2020 was certainly a year for the record books with a global health crisis that forced economic impacts across the globe. As we now approach 2021, financial institutions are looking at an era of unprecedented uncertainty in lending, as potential write-offs loom and the effects of a low-interest rate environment inhibit profitability. However, the year ahead also reveals some unique opportunities for financial institutions. To compete, you need to create a competitive advantage for your lending products and meet consumers where they are (online). Transparency, flexibility, peace-of-mind — now is the time to provide value that goes beyond just a competitive rate. Give consumers a reason to choose your loan.

Branchless Digital Natives: Much of the allure of online lending lies in the speed and transparency of the end-to end process. Self-service tools and options make it possible for consumers to keep tabs on the status of a loan application, while also cutting resource costs for institutions. Branchless digital natives have digitized the end-to-end lending process, gaining significant efficiencies from automation. As firms face the imminent challenges of 2021, realizing cost savings through digital efficiencies should be a top priority.

Digital Adoption: Firms will need to focus more on strategic adoption of digital assets, reaching toward end-to-end digitization, rather than the piecemeal addons that marked early approaches. End-to-end digitization relies on automated workflows and a single source of data to connect front and back office operations. Instances of repetitive or non-value-added work are reduced in favor of real-time processing. With real-time processing, financial institutions gain immediate access to data and insights, empowering a faster lending lifecycle.

Open Banking: Cloud-based APIs are at the heart of fast and efficient digital transformation strategies. Adoption of cloud-based APIs will usher in a new era of open banking and opportunities for future expansion into a broader ecosystem, where financial institutions can explore offerings and consume them at speed.

Covid-19 had a widespread impact across the global economy. Now financial and lending firms must stay focused on speed, agility and efficiency to make it through 2021.

Keep Reading

Simplifying payments with Open Banking

As financial institutions shift toward a digital end-to-end lending process, they are setting the groundwork for a new era in banking founded on Fintech partnerships and an open ecosystem.

Rise of open banking

Open Banking—driven by regulatory, technology and competitive dynamics—calls for banks to use APIs to make certain customer data available to non-bank third parties. The innovation is both evolving the industry toward hyper-relevant, platform-based distribution and giving banks a rich opportunity to expand their ecosystems and extend their reach.

Open Banking has become a global movement driven by regulatory, customer and ecosystem forces, each shaping the outcomes of a bank’s Open Banking initiatives. In order to deliver these outcomes, realize the full value from Open Banking, as well as keep improving their offerings, banks need to measure and monitor not only the key performance indicators (KPIs) specific to Open Banking, but also the impact of these KPIs on the performance of the business at a higher level.

The potential benefits of open banking are substantial: improved customer experience, new revenue streams, and a sustainable service model for traditionally underserved markets.

Simplifying payments

Open Banking grants access to financial data to third-party developers (provided users give their permission). By enabling non-financials to develop APIs around existing banking infrastructure, a host of innovative new services and applications are now improving the customer experience.

Cloud-based APIs are at the heart of fast and efficient digital transformation strategies. Simple plug and play functionality make it possible for financial institutions to adopt an integrated environment of applications, all designed to automate critical workflows to return faster credit decisions. The method of aggregating data across multiple accounts into one, easy-to-use platform, offering customers a 360-degree view of their spending and simplifying the ever-growing number of financial touchpoints customers encounter daily. Open banking will also enhance real-time payments, going head-to-head with the card scheme to enable instant transactions between retailers and consumers.

Sharing of limited data on “thin file” consumers can help to advance financial inclusion goals, pooling limited information to arrive at more precise risk-scoring and credit-underwriting decisions. By introducing more consumers to the formal financial system, open banking increases the market opportunity and the potential to deliver profitable services in the future.

Conclusion

From offering personalized insights to simplifying payment transactions, open banking provides the spark banks need to develop modern financial tools that provide even more value to their customers. As the payments landscape grows increasingly competitive, American banks that embrace APIs will appeal to prospective customers with innovative services while strengthening loyalty among their existing clientele.

Tech Bites

Is your Software safe from CSRF attack?

Cross-Site Request Forgery (CSRF) is an attack that forces an end user to execute unwanted actions on a web application in which they’re currently authenticated. With a little help of social engineering (such as sending a link via email or chat ), an attacker may trick the users of a web application into executing actions of the attacker’s choosing. If the victim is a normal user, a successful CSRF attack can force the user to perform state-changing requests like transferring funds, changing their email address, and so forth. If the victim is an administrative account, CSRF can compromise the entire web application. — OWASP.

Why should we be aware of CSRF/XSRF?

An attacker approaches applications based on what an application can be made to do.

Any action that is not specifically denied, is allowed.

An attacker’s aim for carrying out a CSRF attack is to force the user to submit a state-changing request. Examples include:

Submitting or deleting a record.

Submitting a transaction.

Purchasing a product.

Changing a password.

Sending a message.

CSRF attacks look very authentic, impersonating the user itself, their IP address, cookie etc, by means of say, a compromised Ad or a link, which makes it difficult to distinguish between a legitimate request and a forged one. The significant thing about the CSRF attack is that the request is predictable. Just three pieces of data that make any request predictable and vulnerable:

Where we are posting it

How we are posting it

What we are posting

So we need to add some unpredictability here.

Enforcing Persistent authentication like using Httponly flags, is a workaround, even then it is still vulnerable to CSRF attacks. CSRF is specific to cookies

Some of the best mitigation strategies would be:

Reauthentication

Including unique Anti Forgery tokens in every POST, PUT, and DELETE requests. Include them in both cookie header and body.

Add libraries that have built-in CSRF protection.

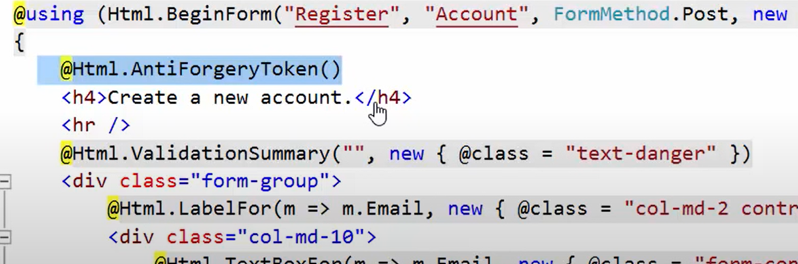

Let’s see this example. Given in the image is a code for a basic registration form. You have all the predictable data in the form, but we are adding here an AntiForgeryToken. Along with the data, you will also need the Anti Forgery Token along with the form field token to authenticate the request.

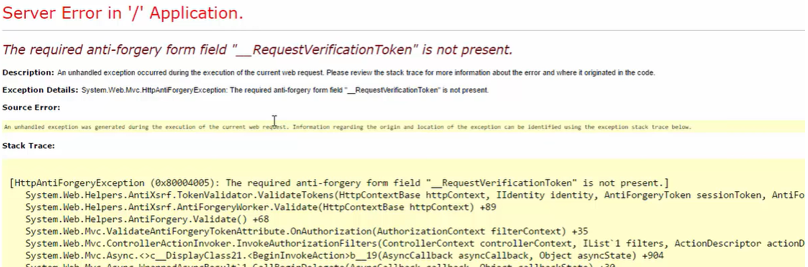

As an attacker, you cannot guess the token and if the request is submitted without the token, code throws an error.

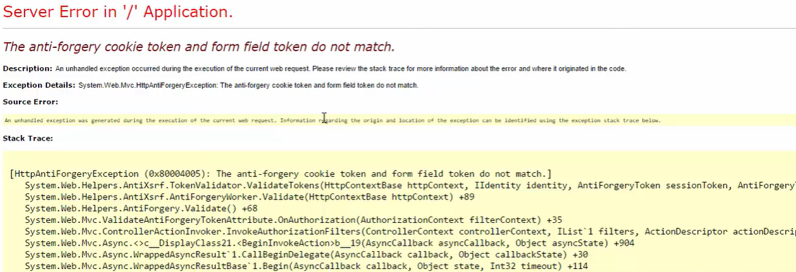

Let’s say, the attackers could replicate the form field token, but since the Anti Forgery token is not predictable and does not match, the code immediately detects it is a fraudulent request and they would get an error.

Developers can generate this token once for a current session. Make sure to not expose your token via AJAX calls.

Online attacks are a reality that cannot be unseen if you are running software on the web today. Attackers target the weak spot/flaws – one that could be prevented by taking appropriate defensive measures.

Get insights to stay ahead in lending industry

Insights delivered monthly !

Banks keen for digital amid open banking

Banking software company Temenos has released a report prepared by the Economist Intelligence Unit (EIU) based on a 2020 survey of over 300 global banking executives, which focuses on how open banking is reducing barriers to entry and breaking the traditional banking value chain.

In Australia, the open banking regime has been in operation by the four major banks since 1 July 2020. In November 2020, the regime was expanded to include mortgage data, which allowed consumers of the four major banks to share their home loan and mortgage offset data to accredited recipients under the new stage of the Consumer Data Right (CDR).

In December 2020, the Australian Competition and Consumer Commission (ACCC) amended the CDR rules to enable more business customers of banks to use it and share their data with accredited data recipients.

The EIU report, titled “Open Banking: revolution or evolution?”, said that when asked what would be the primary way in which they see their current digital business model evolving, 45 per cent of global banking executives are prepared to transform their business models to become “digital ecosystems”.

They said that they envision their banks acting as a “true digital ecosystem”, which would involve offering their own and third-party banking and non-banking products and services to their own customers and to other financial services organizations.

In addition, 30 per cent have responded that they see themselves maintaining their own product offerings and becoming an aggregator of third-party banking and/or non-banking products (personal financial management (PFM) comparison websites etc), while 12 per cent see themselves developing a niche proposition for their own customers, and 10 per cent see themselves becoming an aggregator of third-party products and services only (PFM comparison websites etc).

According to the report, open banking could generate more innovation and competition globally, and lead to improved end-user experience.

Furthermore, the report noted that incumbent banks could be the biggest beneficiaries of open banking, “providing that they adopt adequate technology strategies to compete with nimble new entrants”. According to the report, open banking could benefit banks by making it easier for them to “leverage” their own data internally for enhanced service personalization, with 32 per cent of the survey respondents citing this as a top priority.

In addition, the report has suggested that banks could also play a leading role in digital identification.

The survey also found that the second most chosen innovation strategy globally was open bank hub initiatives that give customers the option to connect their bank data with third-party providers, with 29 per cent of respondents citing this as an option. This figure had risen to 32 per cent in Asia, and 36 per cent in Africa and the Middle East.

In addition, while the survey has found that while 87 per cent of countries reportedly have some form of open application programming interface (API) in place, the report said the evolution of open banking would depend on customers being confident enough about sharing their data, interoperability, enhanced user experience, and the actual added value of products and services for customers.

Speaking further about this, Open Banking Europe managing director John Broxis said: “Opening up banking isn’t enough unless you can prove to your customer base the certainty of how their data is going to be treated, certainty about refund periods and reconciliation information, or certainty about what happens if you do something wrong.”

The report cited Nordic API Gateway CEO Rune Mai, who said that more robust, widespread APIs, systems that operate reliably, and quick responses to API requests would make for an enhanced user experience, and ensure that customers who attempt new functions would continue to use them.

Mr Mai believes that banks have increasingly seen open banking as an opportunity to bring new functionality to market, by often using technology that could be developed and implemented more efficiently, the report said. “This is a great opportunity for banks, once you explain it,” he said in the report.

“APIs… are a way of sealing off incumbents’ core systems and allowing the banks to move at the same speed as anyone else.”

Commenting on the report, Temenos chief strategy officer Kanika Hope said: “Open banking is lowering barriers to entry and breaking the traditional banking value chain. It is forcing banks to rethink their business models and decide whether they want to be manufacturers or distributors of financial products or both.”

Monthly Auto Loan payments surge to record high

Monthly auto loan payments surge to record highs as borrowing hits biggest one-year jump, Experian says.

The average monthly loan payment for a new car is approaching $600 , which analyzes millions of new and used vehicle loans. Experian’s latest auto financing report covers the fourth quarter of last year when new vehicle sales improved but were still well below the pace of sales in 2019.

Nonetheless, those taking out loans to buy a new vehicle borrowed an average of $35,228, an increase of almost $2,000 from a year earlier. As a result, monthly loan payments jumped $13 to a record high of $576 according to Experian. Loans for used vehicles also hit all-time highs, with consumers borrowing an average of $24,467, up almost $1,700 year over year. Experian says monthly payments for used auto loans jumped $18, to $413 — the first time the average topped $400.

Used car and truck prices are climbing due to greater demand during the Covid-19 pandemic. That further tightened the already-strong used car market, where approximately 40 million vehicles were sold last year according to Zabritski.

Despite the increased borrowing and higher payments, the number of consumers defaulting or falling behind on their auto loans remains below the historical average.

LIBOR receives official end date

The Financial Conduct Authority (FCA) announced today that LIBOR will officially no longer be published by ICE Benchmark Administration (IBA) or regulated by the FCA. Recent announcement also substantiates the prior thought that most USD LIBOR tenors will continue past year-end 2021 for legacy contracts. However, U.S. banking regulators previously stated that LIBOR may not be used on originating loans after Dec. 31, 2021.

This announcement coupled with other statements from regulators have made it clear that LIBOR is ending and that users of LIBOR need to continue transitioning away from its use and move to an alternative benchmark. For lenders, this announcement may mean that a trigger event has occurred under its loan documents. This could mean that a lender must begin sending out notice of this event to its borrowers that are affected. Lenders must review the language within their documents to know what steps are required of them based upon this announcement.

The extension decision received wide praise from U.S. banking regulators, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency. So much so, that each of FCA and IBA, LIBOR’s regulator and administrator, respectively, released statements regarding the precise date that LIBOR panels will end. Specifically, FCA announced that “all LIBOR settings will either cease to be provided by any administrator or no longer representative” in accordance with the following schedule:

Immediately after Dec. 31, 2021, in the case of all sterling, euro, Swiss franc, and Japanese yen settings, and the one-week and two-month USD settings; and Immediately after June 30, 2023, in the case of the remaining USD settings.4 Following these announcements, the International Swaps and Derivatives Association (ISDA) announced that these statements are considered an “Index Cessation Event” under the ISDA 2020 IBOR Fallback Protocol5 6, which triggers a “Spread Adjustment Fixing Date” under the Bloomberg IBOR Fallback Rate Adjustments Rule Book.7 As such, the cessation of USD LIBOR tenors after June 2023 in accordance with the above announcements will cause existing USD credit facilities to fall back to the applicable Secured Overnight Financing Rate (SOFR) plus the spread adjustment that has been set as a result of today’s announcement.8 More LIBOR remediation update and information can be found on the LSTA website. Taft strives to provide legal updates on issues impacting our clients. Taft’s LIBOR transition team provides advice and thought leadership on the many challenges associated with the LIBOR transition. Please reach out to us with any questions or if we can be of assistance regarding this transition or any of your finance law needs.

Events

Finovate Europe

23-25 March 2021, Online Virtual Event

Key Stats

Central Bank Interest Rates and Current Libor Rates

| GBP Libor (overnight) | Interest (09-03-2021) | Central Banks | Interest Rates |

| Euro Libor | -0.58143% | American Interest rate (FED) | 0.25% |

| USD Libor | 0.07725% | Australian Interest rate (RBA) | 0.10% |

| CHF Libor | -0.79960% | British Interest Rate (BoE) | 0.10% |

| JPY Libor | -0.07700% | Canadian Interest Rate (BOC) | 0.25% |

| GBP Libor | 0.04025 % | Japanese Interest Rate (BoJ) | -0.10% |